In the evolving landscape of digital finance, isolation is no longer an option. A blockchain that cannot interact with others is like a city cut off from trade routes—its growth is stunted, its influence constrained. Dusk, from the outset, recognized this challenge. Its mission is not only to offer privacy and compliance but to act as a connective hub, a central junction where regulated digital assets can move freely across chains while remaining secure, auditable, and compliant. In a world crowded with siloed networks and fragmented liquidity, Dusk stands apart: it enables assets to flow, interact, and evolve, turning static holdings into dynamic instruments of opportunity.

At the heart of Dusk’s approach is the philosophy that interoperability and regulation are not mutually exclusive. Too often, bridging protocols prioritize speed or liquidity at the expense of oversight, leaving institutions wary and users exposed. Dusk flips this paradigm. Its infrastructure ensures that cross-chain transactions adhere to regulatory requirements while preserving the privacy and confidentiality essential for institutional-grade finance. Imagine a highly secure customs hub at a global port: every shipment is carefully inspected, yet movement remains efficient, fluid, and predictable. In this analogy, Dusk is the customs hub for digital assets, ensuring compliance without slowing the flow of value.

This capability has profound implications. For institutional participants, the ability to deploy assets across multiple chains without navigating complex workarounds is transformative. Consider a tokenized security issued on Dusk that needs to access a lending protocol on another chain. Without interoperability, the asset is essentially trapped—its liquidity constrained, its potential unrealized. Dusk changes this equation. Through its cross-chain architecture, the token can participate in lending, staking, or yield-generating protocols elsewhere while retaining the compliance and auditability required by regulators. The result is a fluid ecosystem where assets are not static, but active, constantly finding the most efficient paths to generate value.

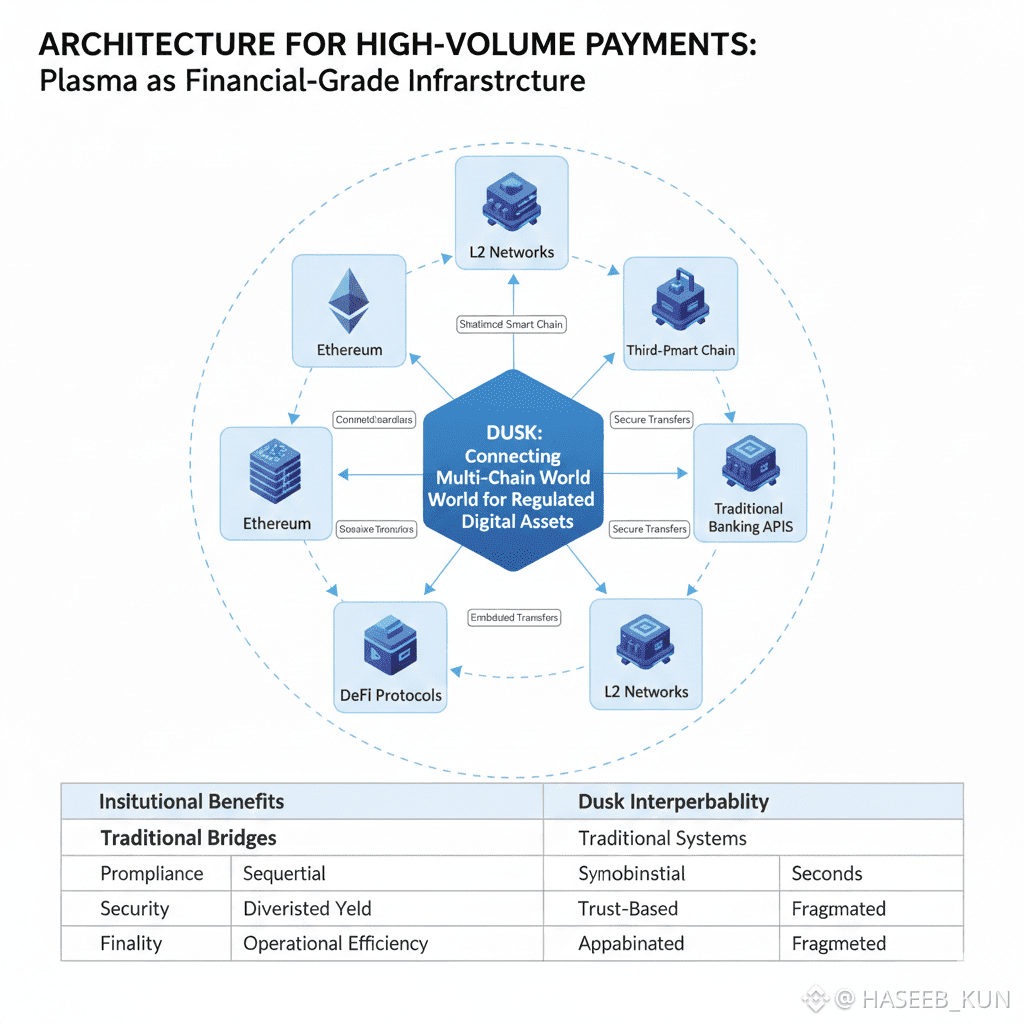

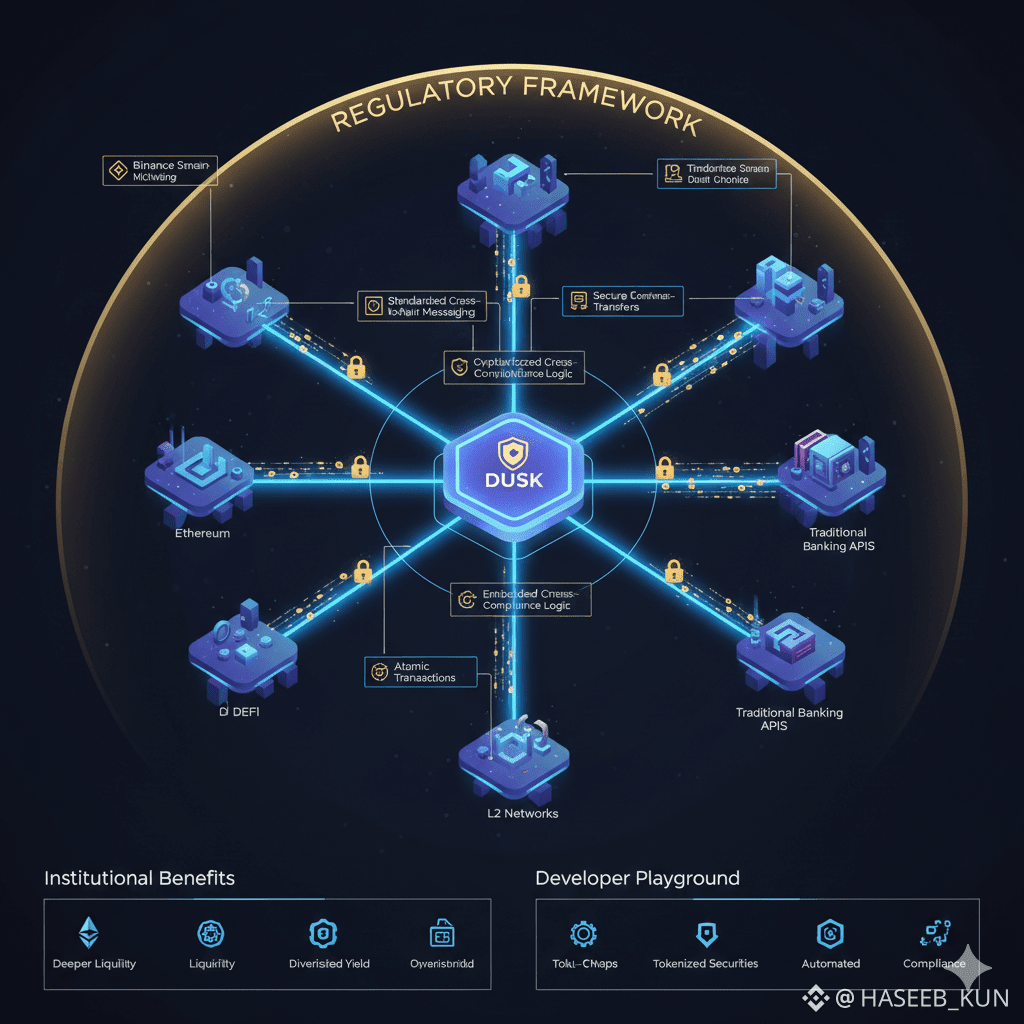

The technology behind this fluidity is both modular and elegant. Dusk employs standardized cross-chain messaging, cryptographic proofs, and a smart contract environment built for composability. Developers can integrate new networks without rewriting core protocols. Compliance logic is embedded at the protocol level, not tacked on afterward. This design ensures that every transaction is validated, secure, and regulatory-compliant, regardless of the chain it touches. Unlike traditional bridges that rely on trust or custodianship, Dusk guarantees that regulatory and privacy standards are upheld natively.

For developers, this creates a playground of possibilities. Multi-chain applications can now be built with confidence, knowing that underlying compliance and privacy considerations are handled by the infrastructure itself. A derivative contract could reference liquidity pools across Ethereum, Binance Smart Chain, and Dusk simultaneously, while settlement occurs seamlessly and securely on Dusk. Tokenized bonds, corporate treasuries, and digital securities can be deployed across chains without manual intervention or risk of regulatory breach. In short, the infrastructure allows human ingenuity to thrive without being bogged down by operational and legal friction.

The human side of interoperability is just as critical. Traders, fund managers, and institutions often struggle with the technical complexity of moving assets across chains. Each network has its own wallet systems, languages, and compliance rules. Dusk simplifies this by offering a unified interface that abstracts these complexities. Users interact with their assets naturally, while the infrastructure handles the intricacies behind the scenes. This design not only streamlines operations but instills trust—users are confident that their assets move safely, regulators are confident that compliance is enforced, and developers are free to innovate.

Consider the broader financial ecosystem. The rise of tokenized assets and multi-chain DeFi platforms has created immense opportunity, but also significant fragmentation. Liquidity pools are spread across dozens of networks, protocols have different rules, and the risk of operational error is real. Dusk functions as a stabilizing hub, aggregating liquidity and ensuring assets can flow between networks without losing their regulatory integrity. This aggregation is critical: it creates a foundation for larger, more sophisticated financial products that were previously difficult or impossible to implement in a multi-chain world.

The strategic value of Dusk’s interoperability extends beyond technical efficiency. In today’s digital finance landscape, the ability to move assets securely and compliantly is a competitive advantage. Institutions that can deploy multi-chain strategies effectively gain access to deeper liquidity, more diversified yield opportunities, and greater operational flexibility. Dusk’s hub model allows regulated assets to participate in this new ecosystem without forcing institutions to compromise on compliance or privacy. In essence, Dusk converts regulatory obligations from barriers into structured enablers, providing both safety and opportunity in one framework.

Real-world scenarios illustrate the power of this approach. A corporate treasury managing tokenized assets can use Dusk to move capital across chains for yield optimization, all while maintaining full audit trails and regulatory compliance. A hedge fund exploring multi-chain arbitrage can execute trades with confidence, knowing that settlement and verification occur securely and privately on Dusk. Even individual investors benefit: stablecoins and tokenized securities can traverse multiple networks, allowing broader access to yield opportunities, trading platforms, and financial products that were previously siloed. The result is a network that feels intuitive and human-centered, even while operating with highly sophisticated technology under the hood.

The narrative of Dusk is also one of forward-looking design. As more chains emerge and digital assets proliferate, the ability to integrate diverse networks into coherent, regulated workflows will define success. Dusk is preparing for this future, not by simply building a bridge, but by establishing a hub that ensures every participant—from developers to institutions to users—can operate efficiently, securely, and with confidence. Its focus on privacy, compliance, and multi-chain fluidity positions it to become a central node in the increasingly interconnected ecosystem of digital finance.

Ultimately, Dusk’s cross-chain capabilities are about more than technology—they are about creating a world where regulated digital assets can thrive naturally, without unnecessary friction. The network turns isolated tokens into mobile instruments, fragmented liquidity into aggregated opportunity, and complex regulatory requirements into structured safeguards. By enabling seamless cross-chain interaction, Dusk empowers developers to innovate, institutions to optimize, and users to access opportunities they could never reach before.

In a sense, Dusk is redefining what it means for an asset to be “digital.” No longer confined to a single chain, assets can flow, interact, and adapt in real time across networks. Compliance is not a hurdle; it is a framework that ensures trust and stability. Privacy is not an afterthought; it is a design principle that protects value. And interoperability is not a convenience; it is the mechanism that transforms digital assets into instruments of movement, utility, and growth.

Dusk, therefore, is not just a blockchain. It is a hub, a junction, and a facilitator of a multi-chain reality where regulated digital assets can operate with freedom, security, and purpose. It is the infrastructure that allows the promise of a multi-chain world to become tangible—a network where connections, not isolation, define value, and where human ingenuity, guided by secure and compliant architecture, can finally thrive. In this evolving ecosystem, Dusk is proving that the future of regulated digital finance is not static or siloed—it is interconnected, dynamic, and ready for the opportunities of tomorrow.