While much of the crypto market chases fast narratives and meme cycles, $ETH continues to move quietly but decisively. No dramatic slogans, no viral hype — just steady progress on infrastructure that still powers most of the crypto economy. And that’s exactly why ETH remains one of the most closely watched assets in the market.

Ethereum doesn’t need to prove it belongs here. It already does.

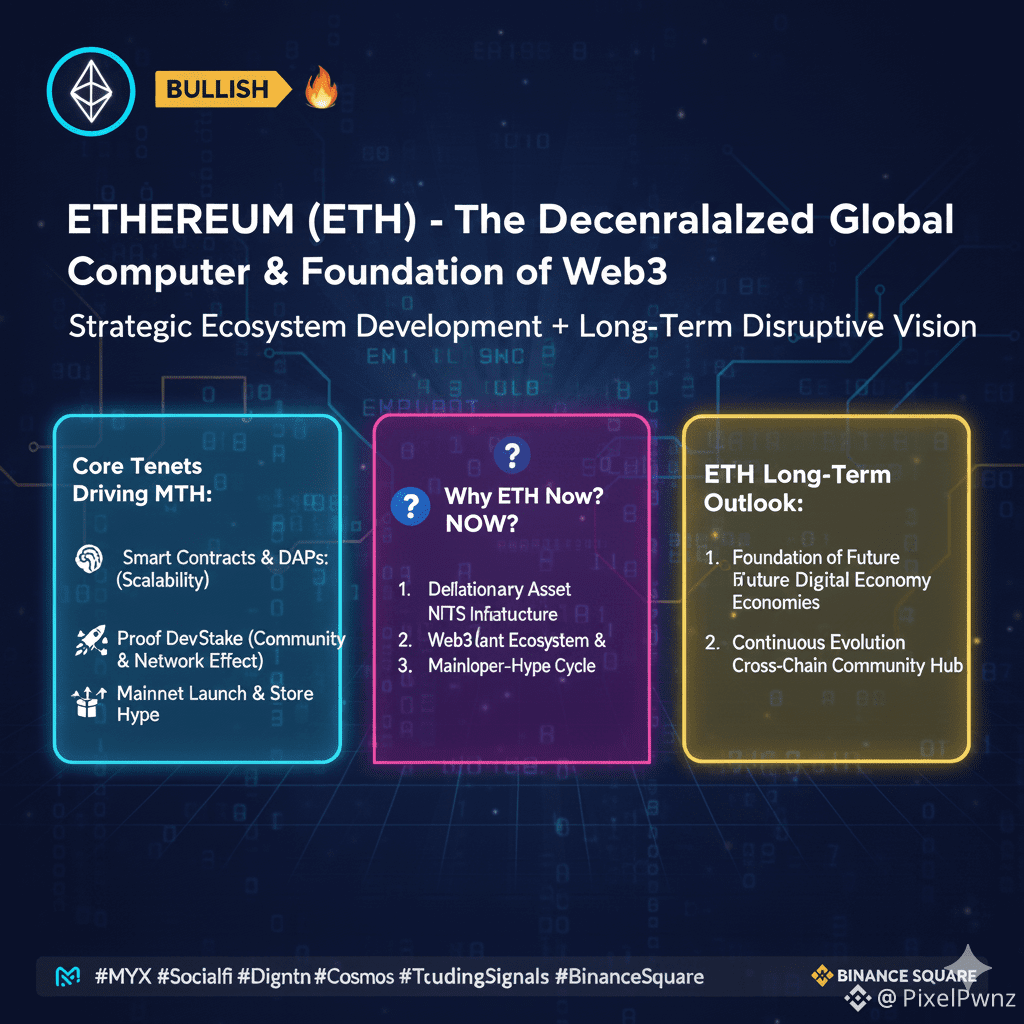

🔧 What’s Driving Ethereum Right Now?

• Layer-2 Expansion Is Accelerating

Ethereum’s biggest strength today isn’t just its main chain — it’s the Layer-2 ecosystem built on top of it. Networks like Arbitrum, Optimism, Base, and others are driving lower fees, faster transactions, and real user activity. Instead of competing with Ethereum, these chains reinforce it, pushing demand back to ETH itself.

As L2 adoption grows, Ethereum increasingly acts as the settlement layer for the entire ecosystem, a role that strengthens its long-term relevance.

• ETH Supply Dynamics Still Favor Scarcity

Since the merge and EIP-1559, Ethereum has introduced a powerful narrative: ETH as a potentially deflationary asset. During periods of high network usage, more ETH is burned than issued. While this doesn’t guarantee price appreciation, it creates a structural shift away from endless inflation — something investors continue to watch closely.

• Institutional and Developer Gravity

Ethereum remains the dominant platform for:

DeFi liquidity

NFT infrastructure

Tokenization experiments

Real-world asset (RWA) pilots

Major financial institutions experimenting with blockchain almost always start with Ethereum or Ethereum-compatible environments. That developer and institutional gravity is hard to replicate — and harder to replace.

🧠 Ethereum’s Role in the Market Narrative

ETH sits in a unique position. It’s not a meme, not a pure store-of-value narrative like Bitcoin, and not a high-speed experimental chain chasing headlines. Instead, Ethereum functions as crypto’s operating system.

That means its growth is often slower, more methodical — but also more resilient.

Even when newer chains capture attention, liquidity, tooling, and long-term builders consistently return to Ethereum. This gives ETH an advantage during market resets, when hype fades and fundamentals regain importance.

⚠️ Risks to Keep in Mind

Ethereum is not without challenges:

Competition from faster, cheaper Layer-1s

Ongoing debates around scaling and user experience

Regulatory scrutiny, especially around staking

Additionally, ETH often underperforms during short-term speculative phases where traders prefer higher-beta assets. Patience is usually required.

📌 Market View: Bullish 📈

Ethereum’s position as the backbone of the crypto ecosystem remains intact. With Layer-2 adoption expanding, deflationary mechanics in place, and unmatched developer activity, ETH continues to strengthen its long-term foundation. While it may not always lead short-term hype cycles, its structural role supports a bullish outlook over time.

Market View: Bullish