When I first looked at Walrus, it wasn’t because the price chart was loud. It was because the design was quiet. In a market that loves fast narratives, Walrus is building something that behaves more like infrastructure than hype: programmable decentralized storage on Sui, where the real product is reliability, and the real moat is incentives. And once you look at WAL through that lens, the token stops being “a coin” and starts reading like a control system that’s meant to keep a storage network honest when nobody’s watching.

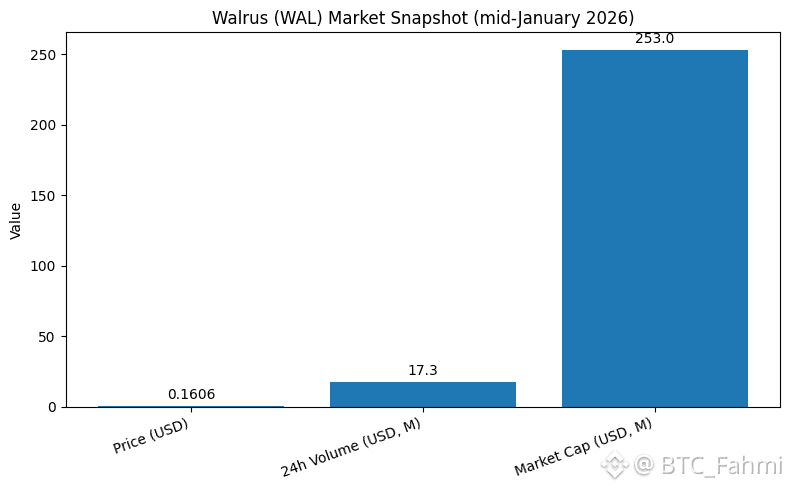

The timing matters too. As of mid-January 2026, WAL trades around $0.16 with roughly $14M–$17M in 24-hour volume and a market cap in the $250M range, depending on the venue you check. That’s not small, but it’s also not a fully matured valuation for the kind of network Walrus is trying to become. CoinMarketCap shows WAL around $0.1606 with $17.3M daily volume and a market cap near $253M, with ~1.58B WAL circulating out of a 5B max supply. Bybit shows a similar snapshot at $0.1606, $14.66M volume, and $252.48M market cap. Those numbers tell you two things: liquidity is real, and the market is still treating this as a mid-cap infrastructure bet rather than a finished story.

But the title here isn’t “From Incentives to Governance” for decoration. WAL is designed to move value and coordinate behavior. Underneath the surface, those two goals are inseparable. Storage networks fail in boring ways: nodes go offline, data becomes unavailable, economics drift, operators cut corners. If you’re Walrus, you don’t solve that with branding. You solve it by making the cheapest behavior also the correct behavior.

Start with incentives, because that’s where reality lives. Walrus positions WAL as the economic anchor that coordinates pricing, resource allocation, and defense against adversarial node behavior. On the surface, that means WAL is used for storage payments and staking. Underneath, it’s a mechanism for shaping supply and demand of storage capacity, and punishing the kinds of operators who try to extract value without delivering reliability. In other words: WAL isn’t just paying for storage, it’s paying for correct storage.

A simple example helps. Imagine you’re building an app that needs to store NFT media or AI datasets, and you’re choosing between centralized hosting and Walrus. Centralized hosting gives you convenience, but the tradeoff is silent control: pricing changes, access rules change, content can disappear. Walrus is trying to replace that with a different texture of trust: you pay into an open network, data is erasure-coded and distributed, and storage providers are rewarded for being available and penalized for behaving maliciously. That’s the pitch. But the real test is whether token design makes that pitch earned, not promised.

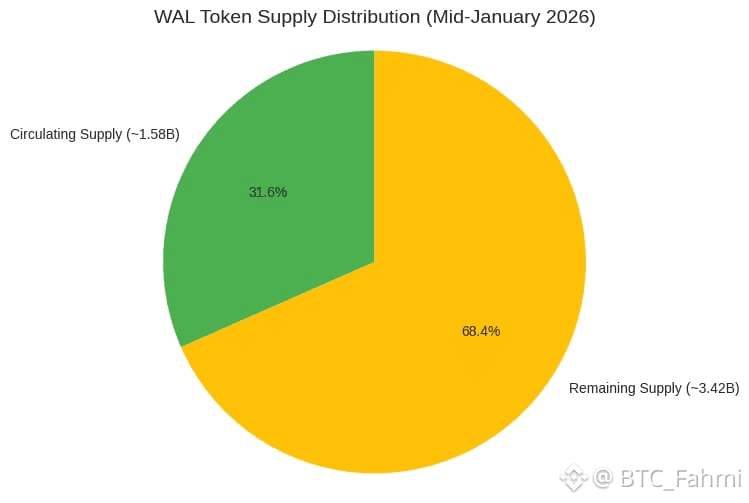

This is why supply structure matters. WAL has a maximum supply of 5,000,000,000 tokens, with ~1.57–1.58B currently circulating based on major trackers. The ratio is important because storage networks are long games. If incentives are too front-loaded, you get a temporary boom of nodes chasing emissions, then decay once rewards soften. If they’re too tight early, you get insufficient participation and reliability risk. WAL’s approach is essentially to use token distribution and ongoing incentives as the “bootloader” for real supply-side capacity, then gradually shift the system so the demand side (actual storage usage) matters more.

That transition is where governance becomes the real story.

Because once incentives create capacity, governance decides what kind of network that capacity serves. WAL governance is supposed to give token holders control over parameters that actually shape the network: economic rates, staking rules, upgrade choices, and potentially what kinds of applications are prioritized. The Binance Academy description frames WAL as being used for multiple roles across the ecosystem including governance, with a deflationary model tied to burning mechanisms. Whether burning is significant enough to outweigh emissions and unlock schedules is a separate debate, but the key point is that governance isn’t cosmetic here. In a storage protocol, small parameters are big levers.

Here’s what I mean by “levers.” If you tweak storage pricing mechanics, you are directly influencing whether the network attracts long-term archival users or short-term speculative demand. If you adjust staking requirements and slashing conditions, you are changing how professionalized the node operator set becomes. If you modify how rewards track uptime and performance, you’re essentially defining what “good behavior” means in code. WAL governance is the layer where those definitions get fought over.

And the fight is inevitable.

The obvious counterargument is simple: token governance often becomes plutocracy. Bigger holders steer outcomes. Smaller holders disengage. Participation drops, and governance becomes performative. That risk is real, and it remains to be seen whether Walrus designs around it or falls into the same gravity well. But there’s another, subtler risk that people miss: even well-intentioned governance can destabilize incentives by changing rules too often. Storage providers don’t invest in hardware and ops based on vibes. They invest based on stable economics. So Walrus governance has to walk a narrow line: flexible enough to improve the protocol, stable enough to keep operators committed.

Recent ecosystem signals show why governance pressure is rising now. Coingecko noted Walrus being integrated into Sui’s “stack” narrative tied to AI infrastructure. Whether you buy that framing or not, it implies a directional pull: more attention, more integrations, more demand for predictable storage. Meanwhile, operational transitions like the Tusky migration deadline on 19 January 2026 show the real world messiness of decentralized tooling. These moments tend to surface governance questions fast because the community suddenly cares about coordination, compatibility, and user protection, not just token price.

So when you connect incentives to governance in Walrus, the deeper point is this: WAL is trying to convert speculative value into sustained reliability. Incentives get nodes online, governance keeps them aligned, and if both work, you end up with an infrastructure asset that the market can price with less fantasy and more math.

In the broader market, that’s a pattern worth noticing. After years of DeFi tokens that mostly subsidized activity, you’re seeing more networks design tokens as operational instruments, where governance is less about slogans and more about keeping a physical-ish system stable. Storage, compute, bandwidth, verifiable AI infrastructure—these aren’t “apps.” They’re services. WAL sits in that category, and if this model holds, it suggests the next cycle won’t just reward attention. It’ll reward networks whose tokens actually manage the messy relationship between users, operators, and long-term cost.

One sharp observation to close on: WAL’s real job isn’t to pump—it’s to make cheating unprofitable, and make coordination feel boring. If Walrus succeeds, the token won’t look exciting. It’ll look inevitable.