For years, I believed keeping money in a bank meant I was being responsible. The balance sat there, untouched, and that alone felt like progress. But over time, something started bothering me. The number barely changed. Interest was almost invisible. Inflation, on the other hand, was very real. That’s when it hit me—my money wasn’t safe, it was just idle.

Banks never really explain this part. They use our deposits to lend, invest, and earn, while giving us the lowest possible return in exchange. The money is technically ours, but it’s working harder for them than it is for us. Once I noticed that, I started thinking differently. Instead of asking how to save more, I started asking how to make the same money move.

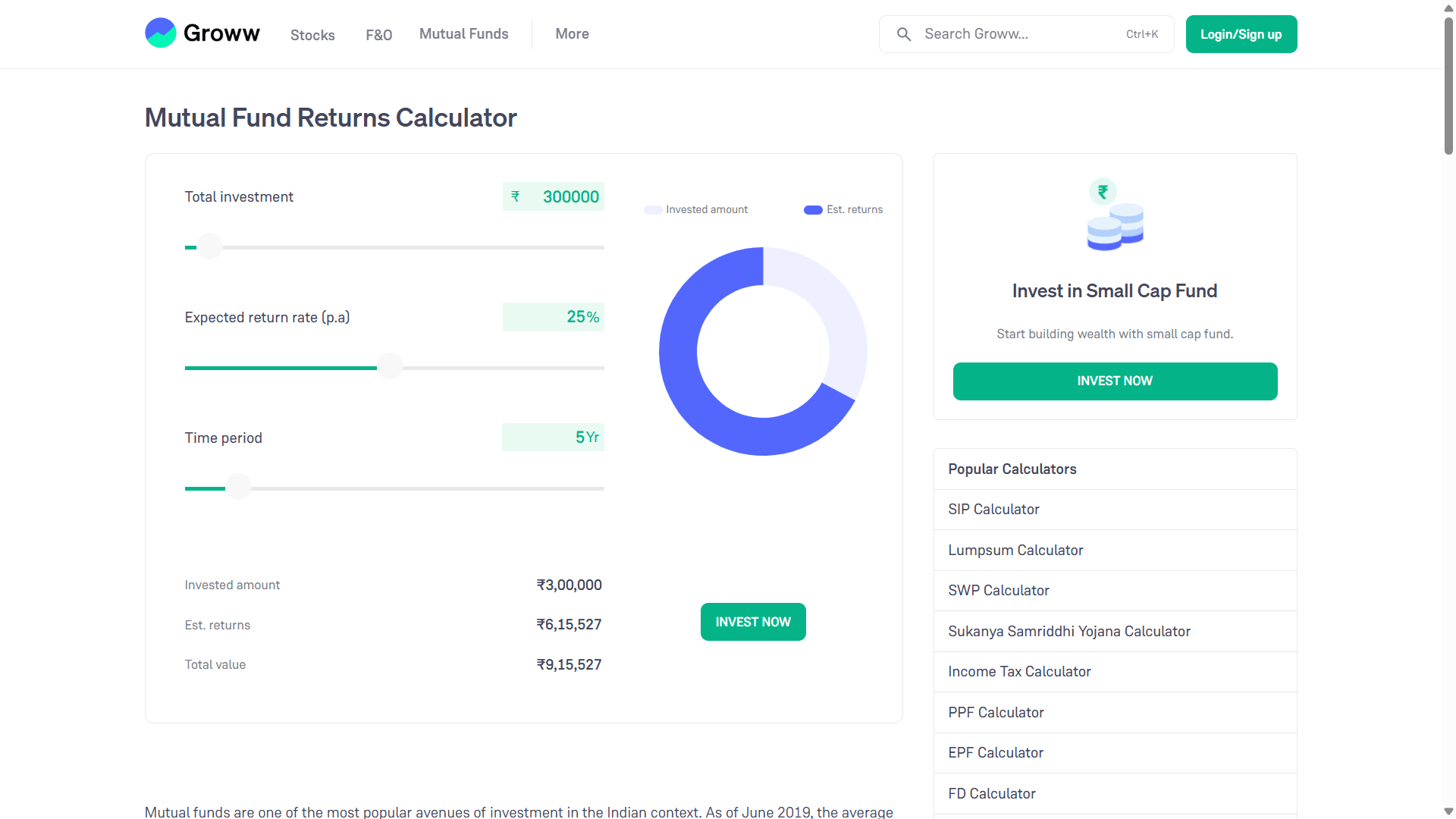

The foundation of this idea is simple. Capital should stay invested in assets that grow over time. Mutual funds are one such place. When you put a lump sum into a growth-oriented fund and leave it there for years, compounding does its job. For example, if someone invests around three lakh rupees and assumes a long-term annual growth rate, the value over five years can grow far beyond the original amount. That’s not guaranteed, but it’s how markets are designed to work over time.

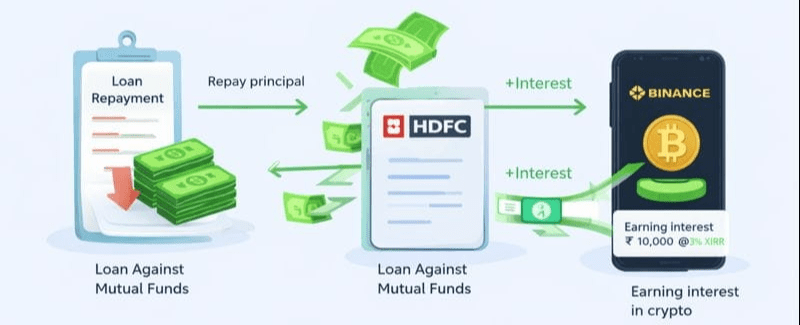

What most people don’t realize is that invested money doesn’t have to be frozen. Instead of selling those mutual fund units, some platforms allow loans against them. This means the investment stays exactly where it is, still exposed to market growth, while a portion of its value becomes usable cash. The interest on such loans is usually much lower than unsecured personal loans, which makes the math interesting if handled carefully.

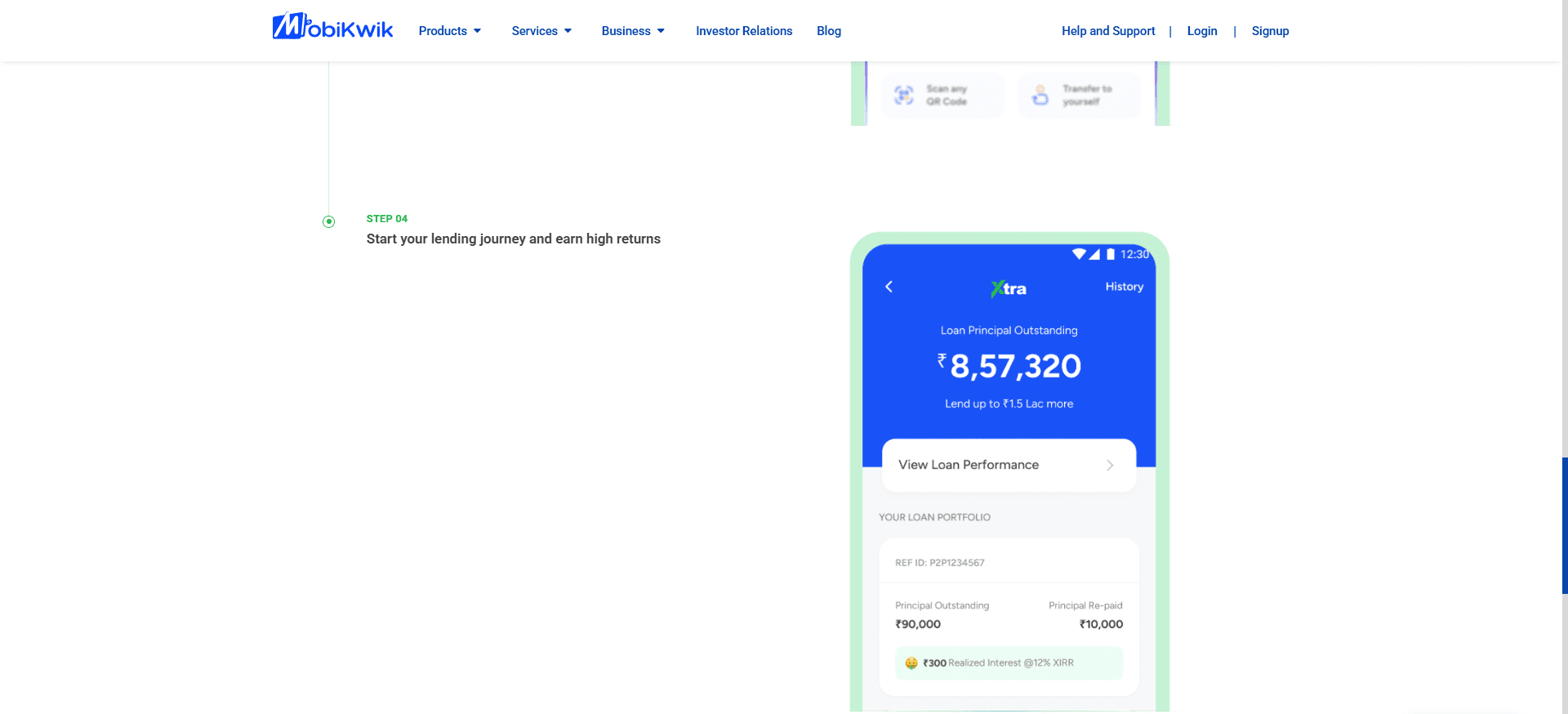

Now comes the part where discipline matters. The borrowed money isn’t meant for lifestyle upgrades or impulse spending. It’s deployed. One example of where people deploy such funds in India is platforms like MobiKwik Xtra, which operates through an RBI-regulated peer-to-peer lending partner. In simple terms, P2P lending removes the traditional bank from the middle. Instead of depositing money and earning almost nothing, lenders provide small loans to many borrowers through technology-driven risk assessment.

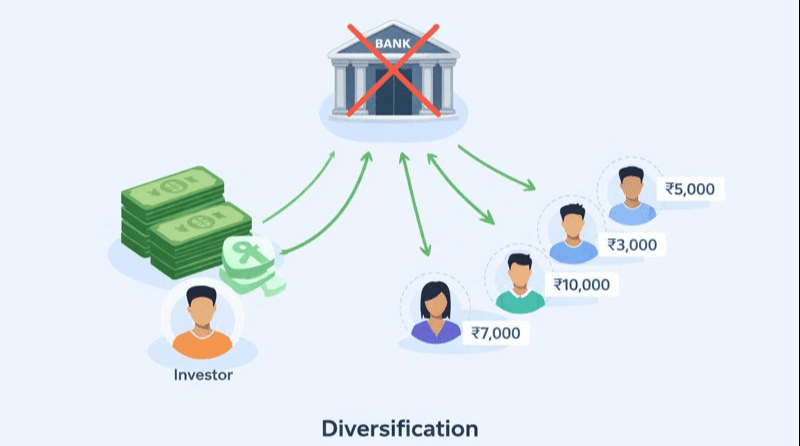

The reason this works is diversification. A single investment doesn’t go to one borrower. It’s spread across dozens or even hundreds of small loans, each with shorter tenures. As borrowers repay every month, both principal and interest flow back to the lender. The platform shows this clearly—how much principal is still outstanding, how much has already been repaid, and how much interest has been earned so far. Over time, this creates steady monthly cash flow.

Here’s where the rotation actually becomes visible. Each month, as repayments come in from lending, the money splits naturally into two parts. The principal portion isn’t treated as profit—it’s used to slowly pay down the loan taken against the mutual funds. Over time, this reduces exposure and lowers overall risk. The interest portion, however, is surplus. That money didn’t come from your original capital; it was generated by the system itself.

Some people choose to redirect this surplus into high-risk, high-volatility assets like crypto, fully aware that this part is speculative and can even go to zero. The important distinction is psychological as much as financial—the original capital remains untouched, still invested in long-term assets, while only the excess cash flow is exposed to higher risk.

When it comes to crypto, platform choice matters more than hype. Large, established exchanges like Binance have built multiple layers of security over the years, largely because they’ve already faced real-world attacks. Instead of ignoring those incidents, they responded by creating recovery mechanisms such as insurance funds designed to compensate users in the event of a breach. No system is perfect, but scale brings accountability, visibility, and stronger infrastructure.

Another reason people prefer such platforms is flexibility. Funds aren’t locked indefinitely. You can move assets, hold them liquid, or reallocate when conditions change. This matters because money rotation only works when capital can adapt. If something feels off, you exit. If an opportunity appears, you enter. The goal isn’t to predict markets, but to stay responsive while managing risk.

Again, this doesn’t make crypto safe. It makes it contained. Losses, if they happen, stay limited to surplus cash—not your foundation. That separation is what keeps the overall structure intact.

So the cycle continues. The mutual fund remains invested. The loan gradually shrinks. The lending platform keeps generating cash flow. The interest gets recycled into other opportunities. Money stops sitting still and starts rotating.

This approach isn’t safe, simple, or suitable for everyone. Markets can fall. Borrowers can default. Platforms carry operational risk. Leverage amplifies mistakes as much as it amplifies returns. Anyone trying this without understanding risk is likely to learn an expensive lesson. This is why it’s not advice, and definitely not a guarantee.

What matters more than the method is the mindset behind it. Wealth isn’t built by letting money sleep forever. It’s built by understanding how capital can move, how risk can be managed, and how cash flow can be structured instead of consumed. The tools might differ from country to country, but the idea is universal. Assets don’t just store value—they can be used.

I’m sharing this not to tell anyone what to do, but to show how thinking changes once you stop seeing money as something to lock away and start seeing it as something that needs direction.