Let’s be honest. In the world of crypto, “regulation” is often treated as a dirty word—a force from the old world trying to clamp down on the new. At the same time, anyone who’s tried to get a bank or a big investment firm to seriously play with DeFi knows the other side of the coin: their number one complaint is always, “We can’t use this; there’s no privacy and no way to comply with the rules.”

It feels like an impossible standoff. That is, until you dig into what a project called Dusk Network has been quietly building since 2018.

Dusk isn’t trying to be the blockchain for everything. It’s laser-focused on solving that exact puzzle: how do you build a financial system that’s both genuinely private and fully ready for the scrutiny of regulators? Their answer isn’t a small tweak; it’s a complete rethinking of the infrastructure itself.

Forget “Privacy vs. Compliance.” Think “Privacy for Compliance.”

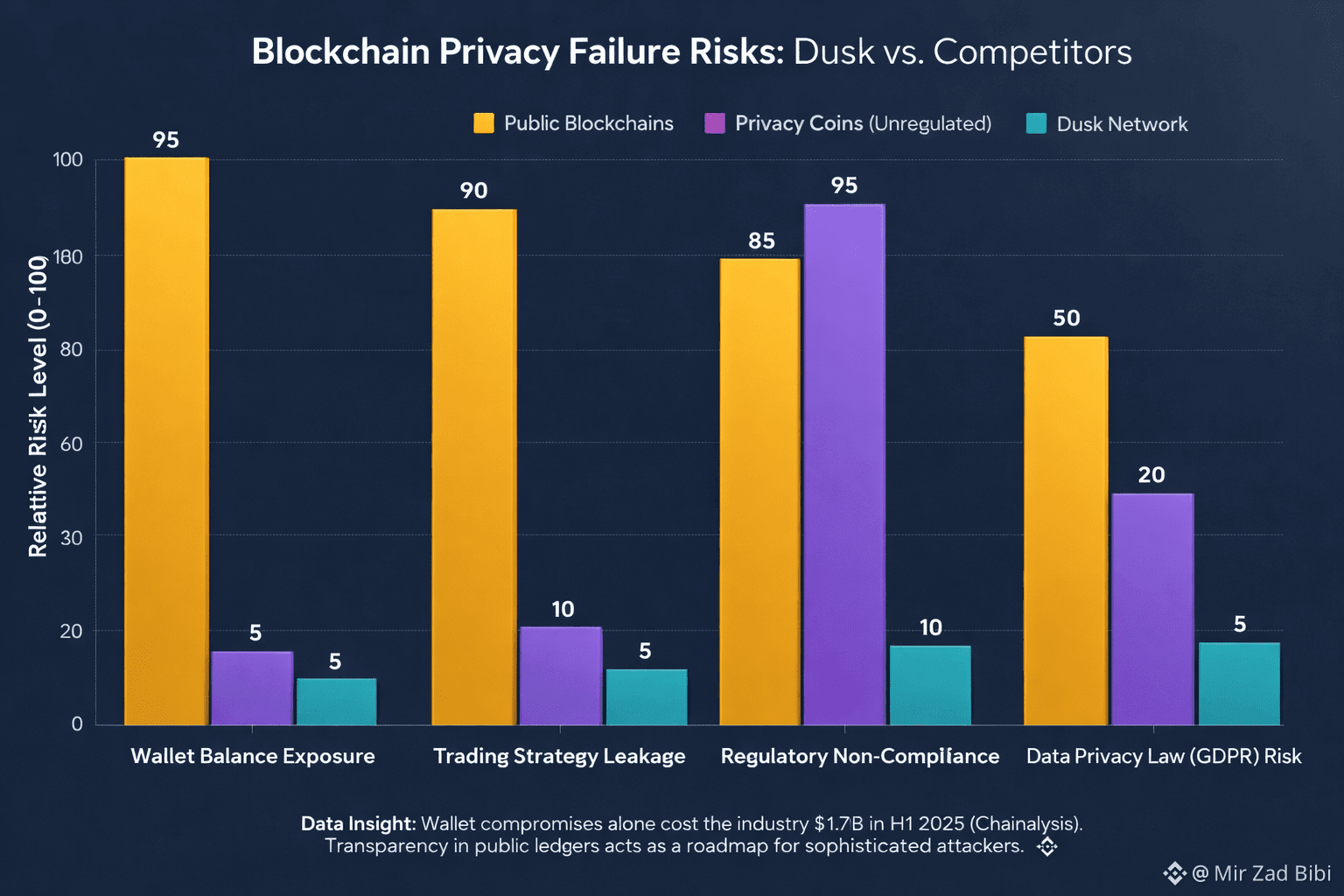

Most privacy blockchains make you invisible. That’s great for personal freedom, but a non-starter for institutions that must prove they’re not laundering money or trading on insider information. Dusk flips the script.

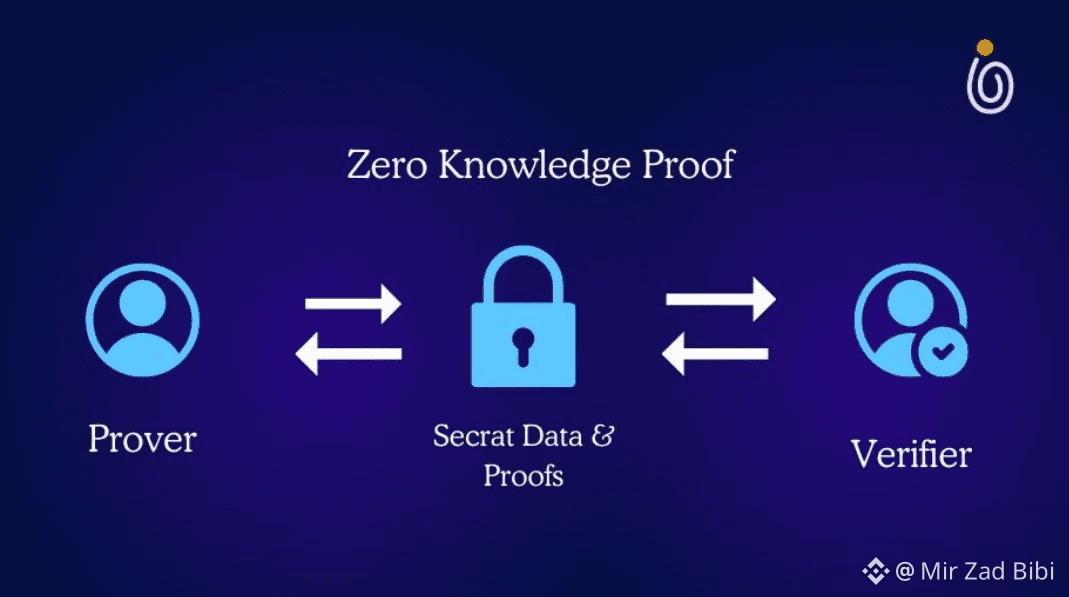

Imagine a sealed, encrypted envelope. You can’t see what’s inside, but stuck to the outside is a notarized, tamper-proof certificate from a trusted authority. The certificate doesn’t reveal the contents, but it states clearly: “The contents of this envelope constitute a legal trade between verified parties. All taxes are paid. No laws were broken.”

That’s the core idea of Dusk. They use something called zero-knowledge proofs—specifically through their own “zkVM”—to let you prove a transaction is correct and compliant without revealing the sensitive details of who, what, and how much. The privacy isn’t for hiding; it’s for creating a safe, professional space where business can happen on-chain.

What Does This Actually Make Possible?

This isn’t just theoretical. This tech opens doors that have been firmly locked until now:

1. Real-World Assets, For Real: Tokenizing a building or a company’s stock on a public ledger like Ethereum is awkward. Do you really want the world watching every partial sale and dividend payout? On Dusk, ownership and transfers can be kept confidential between the parties involved, while regulators get their own cryptographic key to view the proofs they need. It makes on-chain stocks and bonds actually viable.

2. DeFi That Doesn’t Scare Off Lawyers: A decentralized lending pool could require you to prove you’re an accredited investor before you enter—and do it in a way that doesn’t leak your personal data to the entire internet. The rules are baked into the code, and your compliance is baked into your private transaction.

3. A New Kind of Financial Organism: Think of a DAO (a decentralized autonomous organization) that manages a venture fund. Right now, their entire treasury strategy is public for competitors to see. On Dusk, they could operate with internal financial privacy, making deals and managing funds confidentially, while still being transparent to their own members and auditors.

The Human Promise

What excites me about Dusk isn’t just the clever cryptography (though that is deeply cool). It’s the pragmatic vision. The team seems less like crypto anarchists and more like bridge-builders. They’ve looked at the vast, traditional financial world and the vibrant, innovative crypto world and asked, “How do we get these to talk to each other without anyone having to surrender their core needs?”

They’re building the equivalent of a secure, confidential boardroom that happens to exist on a public, global blockchain. It’s a place where the trillion-dollar markets for stocks, bonds, and real estate might finally feel comfortable showing up.

The gamble is big: can they attract the institutions and developers to fill this new space they’ve architected? But the solution they’re offering—a way out of the privacy-regulation deadlock—feels not just timely, but essential. In the end, Dusk Network might just be the project that finally gets Wall Street and Crypto Twitter to shake hands.