In the rapidly evolving world of blockchain technology, stablecoins have emerged as the backbone of digital finance, enabling seamless value transfer without the volatility of traditional cryptocurrencies. As stablecoin adoption surges—surpassing trillions in market cap and powering everything from cross-border remittances to decentralized finance (DeFi)—the need for specialized infrastructure has never been greater. Enter Plasma, a Layer-1 blockchain engineered from the ground up for stablecoin payments. Unlike general-purpose chains that juggle NFTs, gaming, and more, Plasma prioritizes efficiency, speed, and cost-effectiveness for stablecoin users.This article dives into Plasma's core utilities, highlighting its zero-fee transfers, lightning-fast speeds, and innovative Bitcoin integration, while exploring how these features position it as a game-changer in the stablecoin ecosystem.

The Foundation: A Layer-1 Built for Stablecoins

Plasma isn't just another blockchain—it's a purpose-built platform designed to handle the unique demands of stablecoins like USDT (Tether). Launched in 2025, Plasma combines high throughput with stablecoin-native features, including full Ethereum Virtual Machine (EVM) compatibility for easy developer adoption. It uses PlasmaBFT, a custom consensus mechanism that ensures sub-second transaction finality, making it ideal for real-world applications where speed and reliability are non-negotiable.

What sets Plasma apart is its focus on practical utility over hype. While other chains struggle with congestion and high fees during peak times, Plasma optimizes for stablecoin transactions, supporting features like custom gas tokens and confidential transfers. This specialization has attracted partnerships with major players, such as Chainlink for oracle services and Elliptic for compliance tools, ensuring secure and scalable growth.Integrations with wallets like Trust Wallet further simplify user access, allowing seamless stablecoin sends and receives.

Zero-Fee Transfers and Blazing Speed: Revolutionizing Global Payments

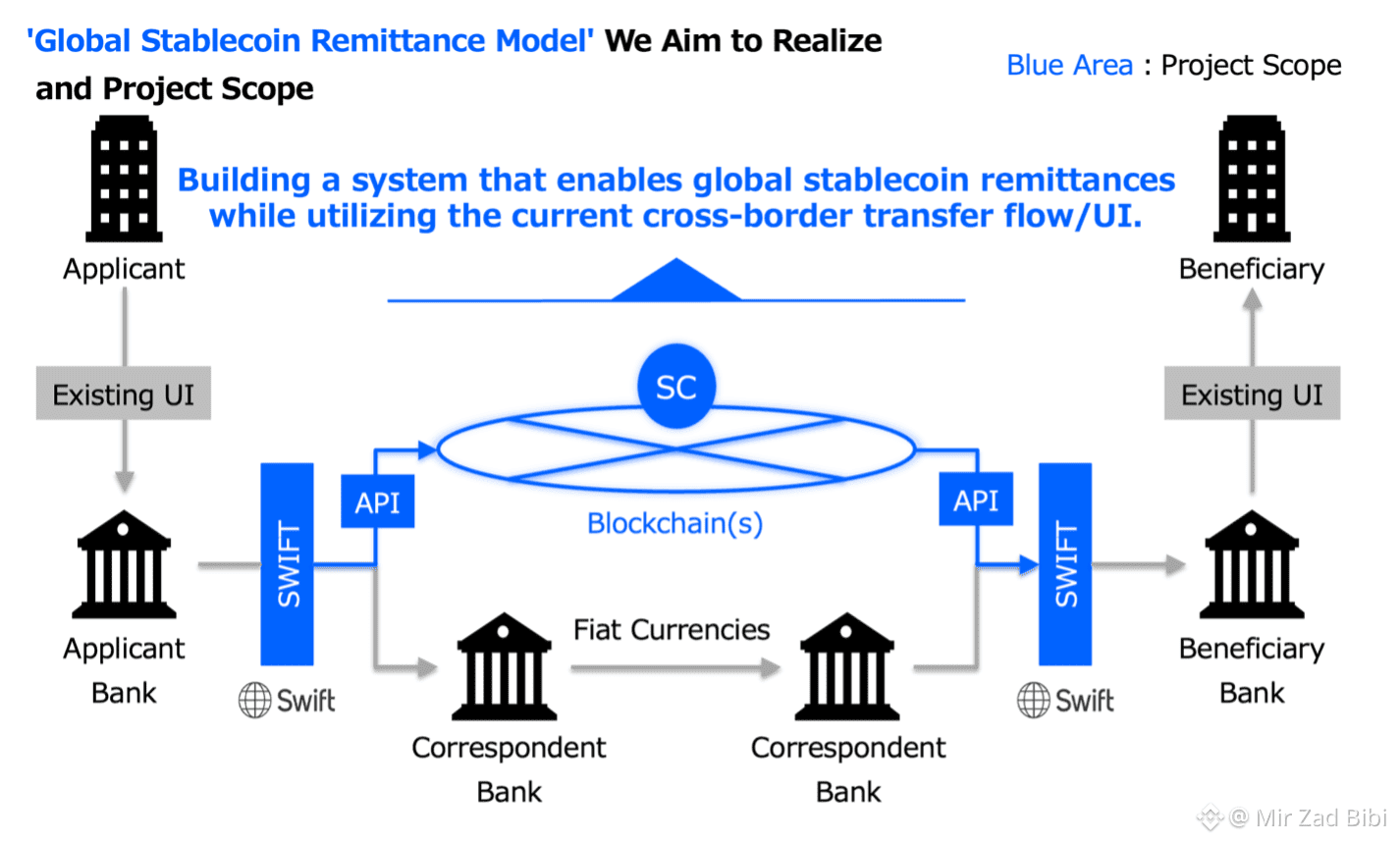

One of Plasma's standout features is its ability to facilitate near-zero fee transfers for USDT and other stablecoins, coupled with transaction finality in about one second.This isn't just a minor improvement—it's a paradigm shift for global payments and remittances, where traditional systems like SWIFT can take days and charge hefty fees.

Imagine sending money to family overseas: On Plasma, a USDT transfer costs virtually nothing and settles almost instantly, bypassing the inefficiencies of legacy finance. This makes it particularly appealing in regions with high remittance volumes, such as Southeast Asia or Latin America, where stablecoins are already disrupting banking. Plasma's gasless USDT transfers mean users don't pay network fees in volatile tokens; instead, stablecoins can serve as gas, keeping costs predictable and low.

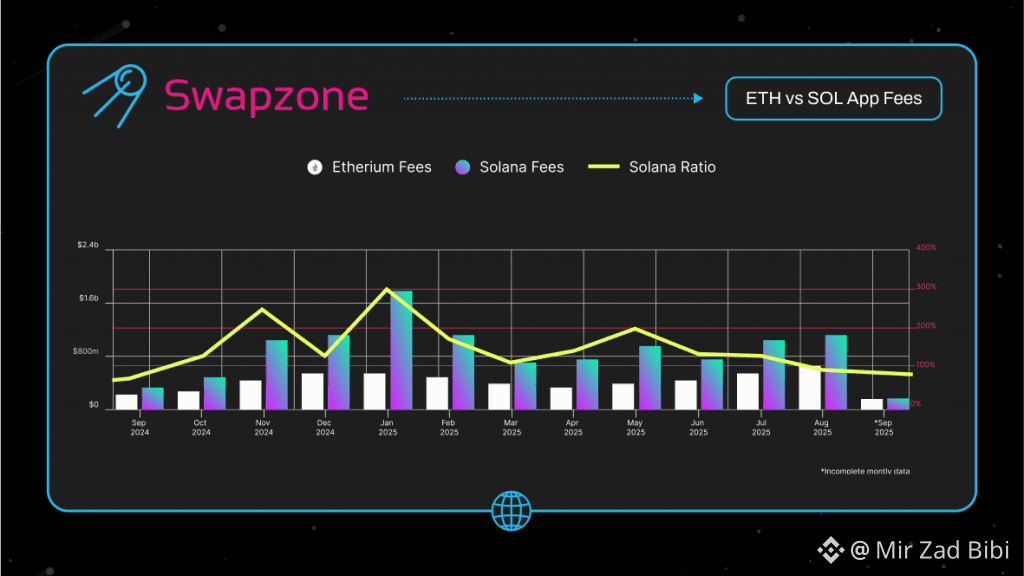

In practice, this efficiency stems from Plasma's architecture, which prioritizes stablecoin throughput over unrelated activities. For businesses, it enables micro-payments, merchant settlements, and payroll without the overhead that plagues chains like Ethereum during bull markets.Recent data shows Plasma handling thousands of transactions per second (TPS) with minimal latency, outpacing many competitors in stablecoin-specific use cases.As stablecoin volumes grow—USDT alone processes billions daily—Plasma's design ensures it scales without compromising on speed or affordability.

Bitcoin Bridge and DeFi: Unlocking Liquidity and Innovation

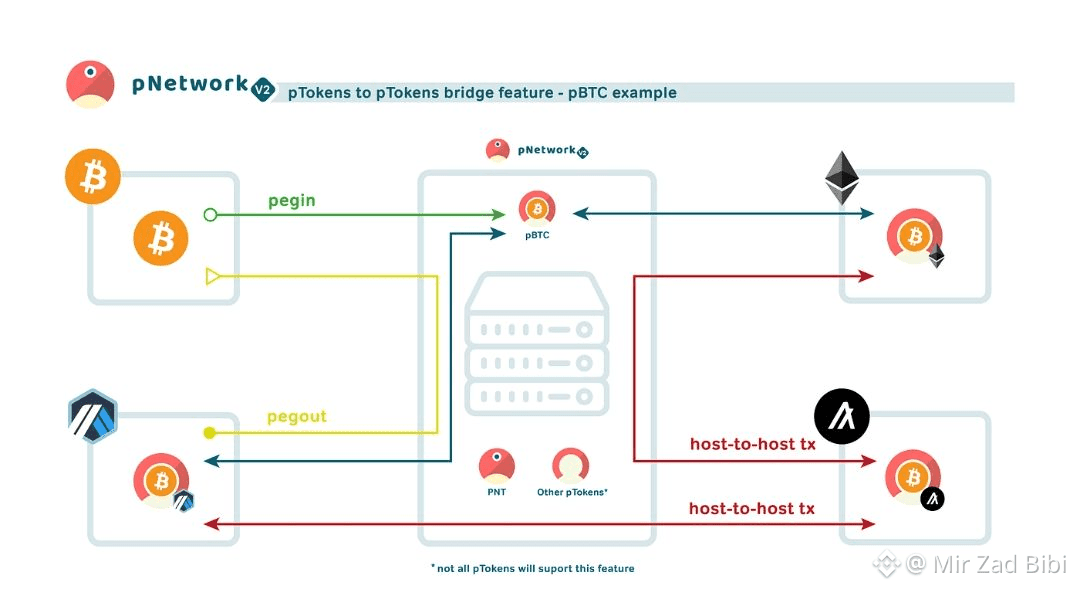

Plasma's ambition extends beyond payments with its trust-minimized Bitcoin bridge, a feature that's drawing significant attention in the DeFi space.This bridge allows users to move native BTC onto the Plasma network as pBTC—a 1:1 backed representation—without relying on custodians or centralized wrappers.The process is straightforward: Deposit BTC to a bridge address, where a network of verifiers confirms the transaction, and pBTC is minted on Plasma for use in smart contracts.

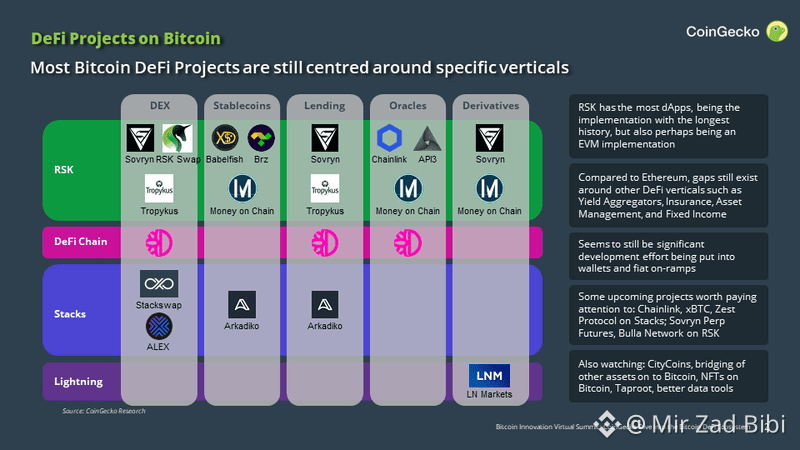

This integration is a big deal because it bridges Bitcoin's massive liquidity—over $1 trillion in market cap—directly into Plasma's EVM ecosystem. DeFi protocols on Plasma can now leverage BTC as collateral for lending, borrowing, or yield farming, all while maintaining the security of Bitcoin's network through periodic state anchoring.Ongoing developments, including collaborations with projects like Aave for ecosystem growth, are set to amplify this potential.

For DeFi enthusiasts, this means new opportunities: BTC holders can earn yields on Plasma without selling their assets, while stablecoin users gain access to Bitcoin-backed products.Tools like the Symbiosis bridge further enhance interoperability, allowing seamless token swaps between Plasma and other chains.As the bridge matures, it could attract billions in BTC liquidity, positioning Plasma as a hub for hybrid Bitcoin-Stablecoin DeFi.

Recent Developments and Future Outlook

Plasma's momentum is building fast. In late 2025, it integrated Chainlink as its official oracle provider, boosting adoption through reliable data feeds for DeFi apps.Partnerships with compliance leaders like Elliptic ensure regulatory readiness, making it attractive for institutional players.

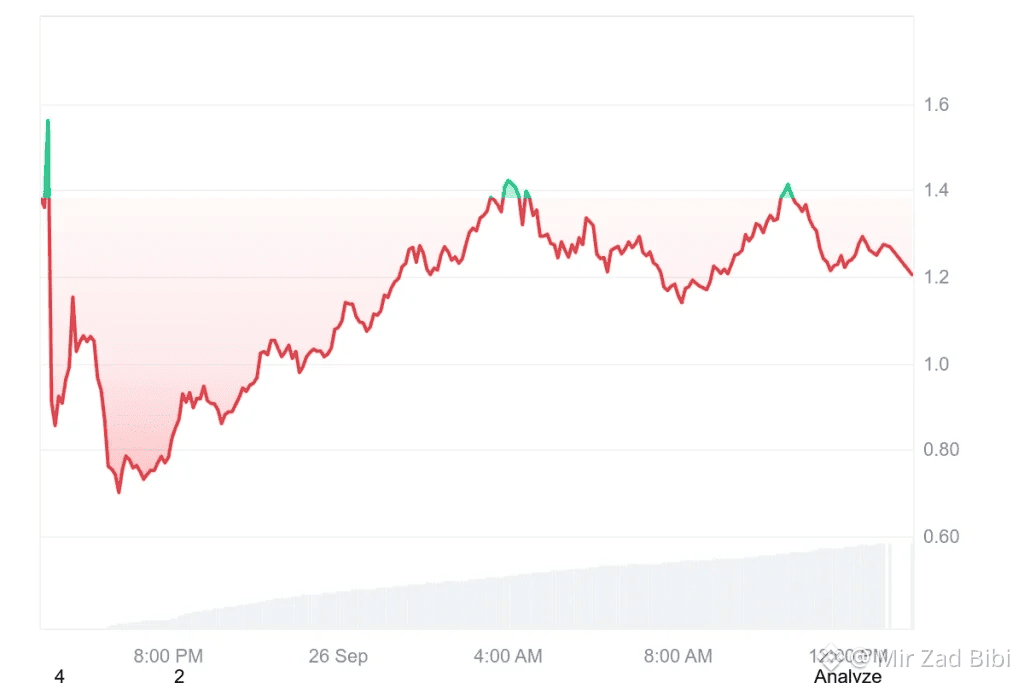

The native token, XPL, powers governance and staking, with trading available on platforms like Bitazza.

Looking ahead, Plasma's focus on real-world utility—payments, remittances, and DeFi—could redefine stablecoin infrastructure. With stablecoins projected to handle even more global transactions, Plasma's specialized approach offers a scalable alternative to overcrowded chains.