Leverage can multiply gains, but it can erase your account faster than you expect. Playing it safe isn’t about avoiding leverage—it’s about controlling it.

Here’s a practical, no-nonsense guide.

1️⃣ Use Low Leverage (Seriously)

Stick to 2×–5×.

High leverage (20×, 50×, 100×) = tiny mistake → instant liquidation.

If your setup only works with high leverage, it’s probably not a good setup.

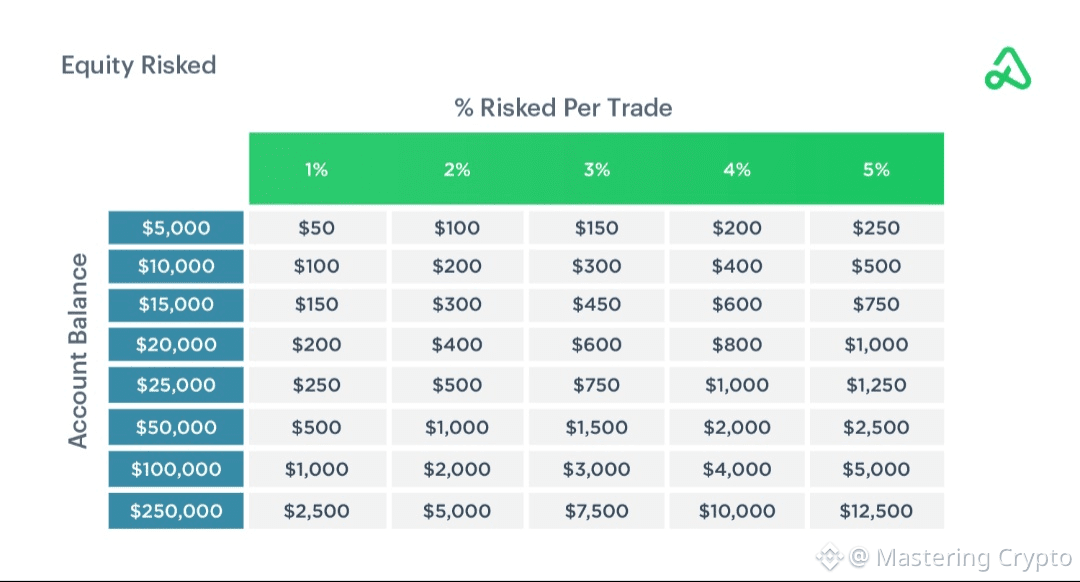

2️⃣ Risk Only a Small % Per Trade

Risk 1–2% of your total capital per trade.

Example: $1,000 account → max risk = $10–$20.

This keeps you alive even after multiple losses.

3️⃣ Always Set a Stop-Loss

No stop-loss = gambling.

Place SL where your idea is invalid, not where it “feels comfortable.”

Accept small losses so you never face a big one.

4️⃣ Position Size > Leverage

Most traders blow up because they:

Increase leverage instead of reducing position size.

Better approach:

Smaller position

Lower leverage

Wider, logical stop-loss

Survival beats excitement.

5️⃣ Avoid Overtrading

More trades ≠ more profit.

Trade only clean setups.

Revenge trading after a loss is account suicide.

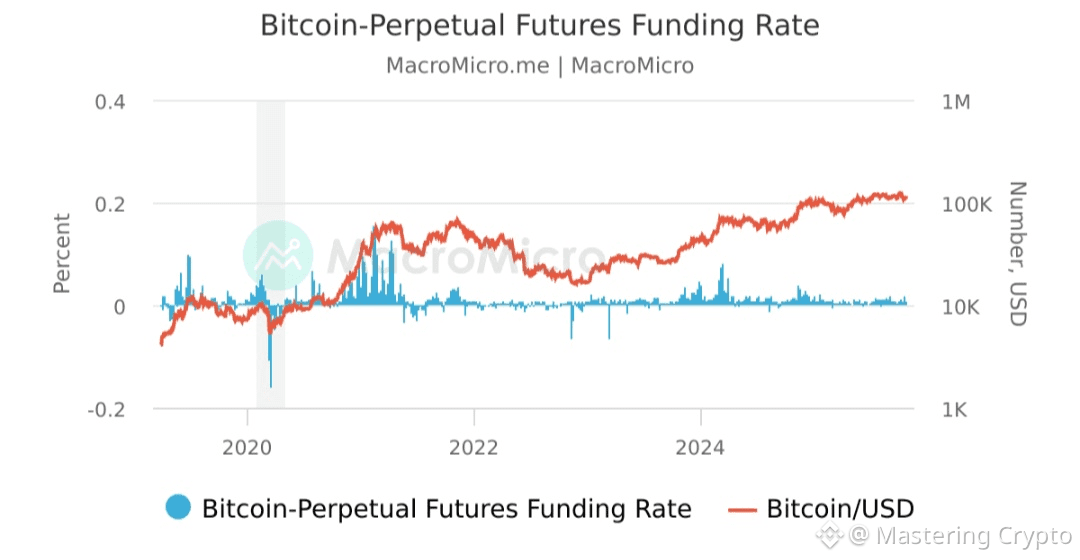

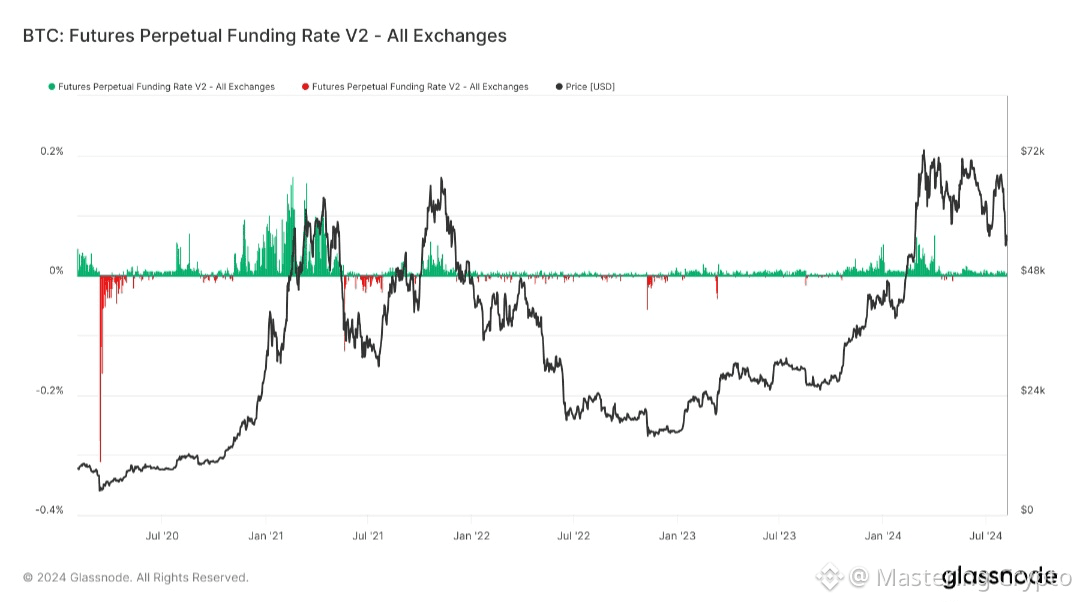

6️⃣ Watch Funding Rates & Volatility

High funding = crowded trade = higher risk.

During news or high volatility, reduce leverage or stay out.

7️⃣ Use Isolated Margin (Not Cross)

Isolated margin limits damage to one trade.

Cross margin can wipe your entire balance in one bad move.

8️⃣ Have a Clear Trade Plan

Before entering, you should already know:

Entry

Stop-loss

Take profit

Risk amount

If you’re “figuring it out on the fly,” you’re already losing.

Final Truth 🧠

Leverage doesn’t make you rich.

Risk management keeps you in the game long enough to win.