Most chains pick a lane early. Either they go all-in on payments and try to feel like a modern money rail, or they go all-in on DeFi and let power users deal with approvals, slippage, fee spikes and complex flows. The problem is that stablecoins are now big enough to demand both. People want stablecoins to work like money, yet liquidity and DeFi rails are still where a lot of stablecoin activity gets routed and priced.

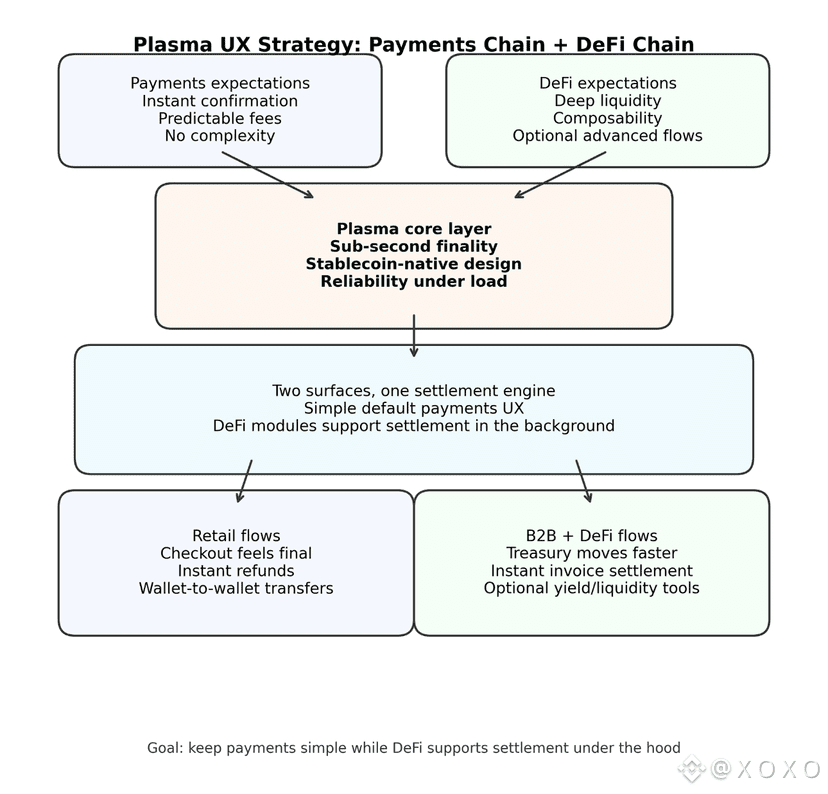

That’s why Plasma’s strategy is interesting. It is trying to act like a payments chain at the surface, while still staying DeFi-capable underneath, without forcing normal users to feel DeFi complexity every time they send stablecoins.

Why this problem is suddenly real

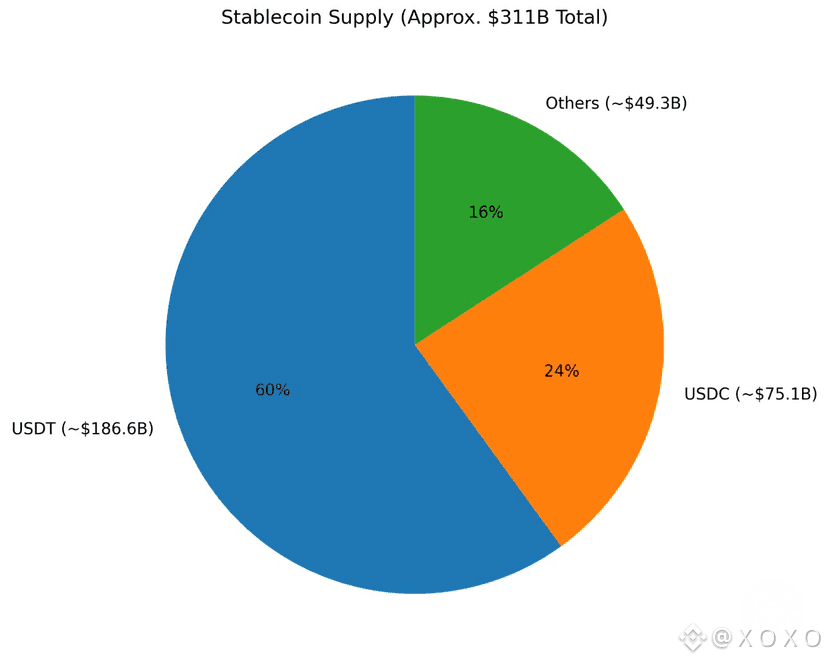

Stablecoins are not small anymore. By the end of 2025, total stablecoin market cap was around the low $300B range, and annual on-chain stablecoin volume has been cited around $33T, which shows stablecoins are already functioning as large-scale settlement rails in practice, even if most users still experience payments through cards and banks.

However, most of that activity has historically leaned heavily toward trading, arbitrage, and crypto-native flows, while real merchant payment acceptance is still early. That gap between “stablecoins move huge volume” and “stablecoins feel normal for payments” is the UX gap Plasma is trying to close.

Payments chains win on one thing: certainty

For payments, users don’t care about composability. They care about a few simple outcomes.

The payment confirms instantly The fee is predictable The balance updates cleanly Refunds are simple There is no anxiety about whether it is final

This is why sub-second finality matters. Not as a benchmark flex, but because payments are psychological. If it feels final, people trust it. If it feels pending, people hesitate.

DeFi chains win on one thing: liquidity and optionality

DeFi is where stablecoins get routed, borrowed, swapped, and used as working capital. Even when someone thinks they are just “sending USDT,” behind the scenes the ecosystem still benefits from deep liquidity and financial primitives that keep stablecoins useful.

The issue is that DeFi UX leaks into payments UX on most chains. Users see approvals, gas confusion, uncertain execution, and interfaces that feel like trading terminals. That is fine for DeFi users. It is a deal breaker for payments users.

Plasma’s bet: two surfaces, one settlement engine

The clean way to combine payments and DeFi is not to mash them together in one user flow. It is to keep the default flow simple, then let DeFi exist as an optional layer that supports the system rather than dominating the experience.

Plasma’s positioning, as described in multiple ecosystem explainers, is stablecoin-first, fast settlement, predictable finality, and a more payment-rail mindset, while still being compatible enough for deeper financial activity to exist on top.

In plain terms, Plasma is trying to make stablecoins behave like money by default, while DeFi behaves like an engine room in the background.

What “not breaking UX” actually means in practice

When Plasma says it wants to support both, the actual UX goal is simple.

A retail user should be able to pay without understanding DeFi A merchant should receive funds quickly and confidently A business should be able to settle invoices and move treasury balances without waiting A power user should still be able to plug into liquidity, yield, and advanced flows when they want

That separation is everything. If Plasma can keep payments clean, then DeFi becomes a value-add rather than a tax on usability.

Why the stablecoin landscape makes this approach logical

Stablecoins are dominated by a few issuers. USDT and USDC alone represent a large share of total stablecoin supply, which is why payments-focused chains often build around deep stablecoin liquidity and predictable settlement behavior instead of trying to optimize for every token category.

That dominance is not just a market fact. It shapes product design. If your chain is meant to carry stable coin settlement at scale, you optimise for the thing that actually moves, not for every narrative.

Final Thoughts

Trying to be both a payments chain and a DeFi chain usually fails because the chain lets DeFi complexity leak into everyday money movement. Plasma’s approach only works if it treats payments as the default experience and DeFi as optional infrastructure that supports it quietly.

If Plasma gets this right, users will not feel like they are using DeFi when they pay. They will feel like they are just sending money, and that is the real win.