"Chronicle of Extreme Volatility in January"

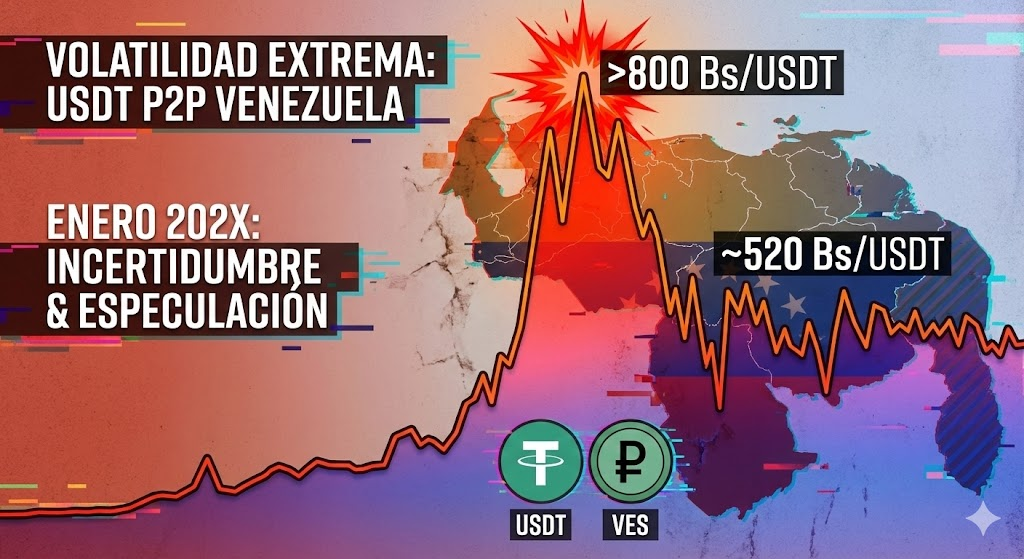

Since the beginning of the year, the price of USDT on Binance's P2P platform has experienced an unprecedented rollercoaster, reflecting the deep economic and political uncertainty Venezuela is going through.

The relative stability the foreign exchange market had shown in recent months abruptly broke on January 3rd. Coinciding with a series of political events related to President Nicolás Maduro's government, demand for USDT surged, driven by fear and the search for refuge amid the bolívar's devaluation.

The Speculation Peak: Over 800 Bs per USDT

Within just a few days, the price of the digital dollar (USDT) on Binance's P2P market broke all barriers, reaching levels above 800 Bs per unit. This sharp increase, illustrated in the infographic below, was driven by a combination of factors: limited foreign currency supply, desperate demand from individuals and businesses, and a strong dose of speculation by certain market players.

The Correction and the New "Normal"

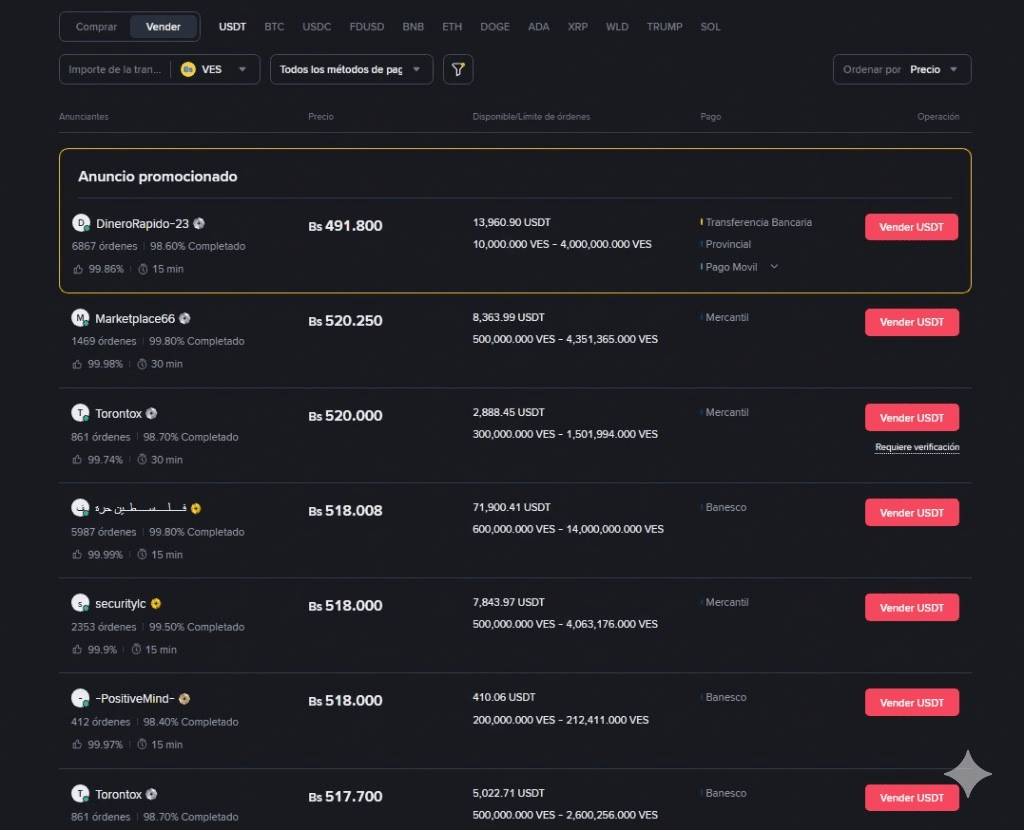

After reaching its peak, the market experienced a significant correction. However, as shown in today's Binance P2P screenshot, the price has not returned to the levels prior to January.

The image shows that the selling price has stabilized within a range of 518 to 520 Bs per USDT for most standard listings. This represents a considerable decrease from the peak of 800 Bs, but it remains a significantly high and volatile value compared to previous weeks. The presence of a promoted listing at 491.800 Bs suggests that some traders are willing to sell at a lower price to quickly obtain liquidity.

Conclusion

The current state of Binance's P2P market is a direct reflection of Venezuela's fragile economic reality. USDT has become an essential asset for preserving money's value, but its price is subject to extreme volatility driven by political uncertainty and speculation. Users must operate with extreme caution, aware of the risks and that prices can change drastically within hours.

#BinanceSquare #BinanceP2P #USDT