While most of the crypto market chases loud narratives and short-term pumps,$SUI has been quietly positioning itself as one of the most technically ambitious Layer-1 blockchains in the space. It doesn’t rely on meme energy or constant hype cycles — instead, it focuses on performance, scalability, and real developer adoption.

That difference is exactly why SUI continues to attract attention during both bullish and uncertain market phases.

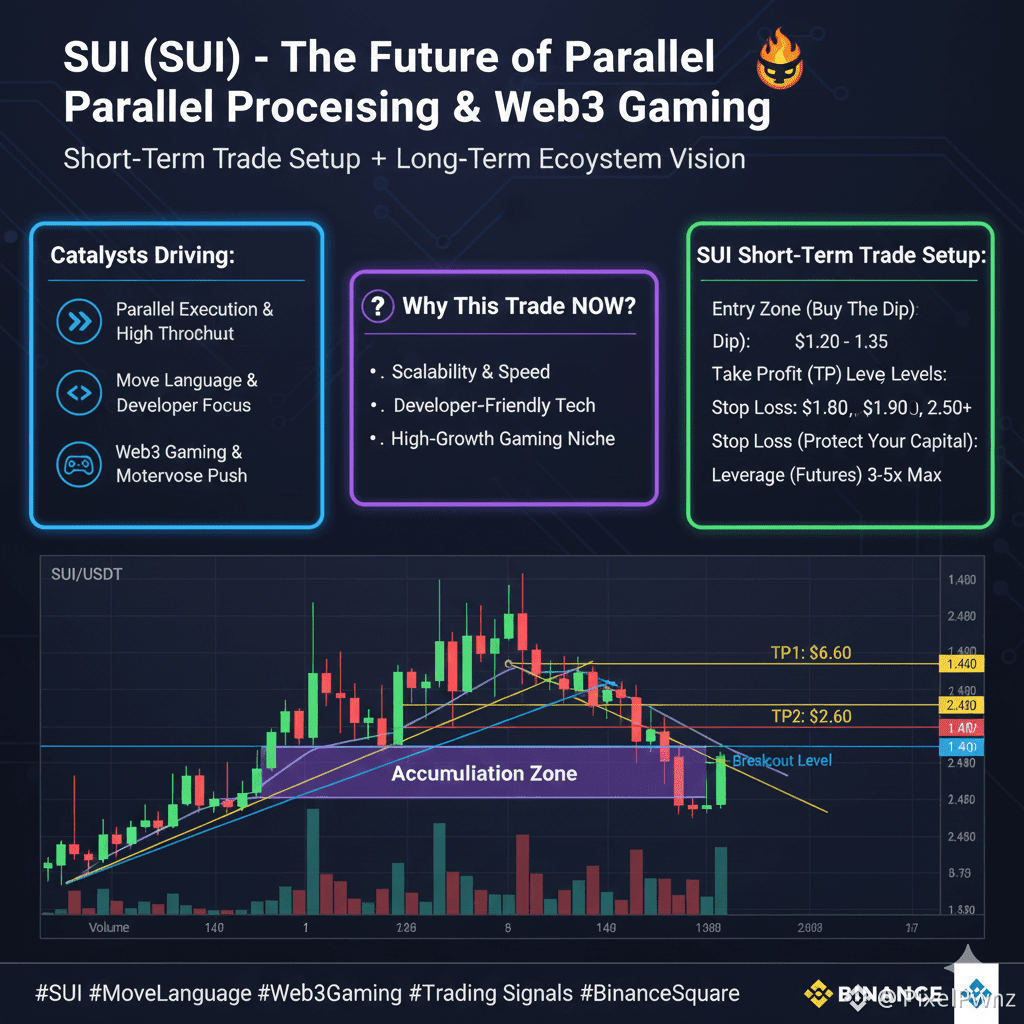

🚀 What Makes SUI Different

Object-based architecture

SUI’s biggest innovation is its object-centric model, which allows transactions to be processed in parallel rather than sequentially. This gives SUI extremely low latency and high throughput — a major advantage for gaming, DeFi, and real-time applications.

Built with Move language

Move, originally developed for Meta’s Diem project, prioritizes security and asset ownership. This reduces smart contract vulnerabilities and makes SUI attractive to serious developers building long-term products.

Strong institutional backing

SUI is backed by Mysten Labs, with deep roots in Big Tech engineering. This gives the project credibility beyond typical crypto startups and positions it well for enterprise-grade use cases.

📰 Recent Developments & Momentum

SUI has been steadily expanding its ecosystem:

Growth in DeFi TVL across lending, DEXs, and liquid staking

Increasing gaming and NFT activity, where low latency matters most

More tooling, wallets, and infrastructure supporting developers

Instead of chasing headlines, SUI’s progress has been incremental — which often goes unnoticed until the market starts rewarding fundamentals again.

⚠️ Risks to Keep in Mind

Highly competitive Layer-1 space

SUI competes directly with Solana, Aptos, and other high-performance chains. Standing out requires continuous innovation and adoption.

Ecosystem maturity

While growing fast, SUI’s ecosystem is still young compared to Ethereum or Solana. Some applications are early-stage and untested in extreme market conditions.

Market dependency

Like all altcoins, SUI’s price action is still influenced by Bitcoin cycles and broader risk sentiment.

🔮 Long-Term Outlook

SUI appears best positioned for:

Gaming and real-time applications

High-frequency DeFi use cases

Developer-driven ecosystem growth

If adoption continues and the ecosystem matures through the next market cycle, SUI could transition from a “promising Layer-1” into a core infrastructure chain.

📌 Final Market View: Bullish 📈

SUI’s strong technical foundation, growing ecosystem, and focus on real scalability give it solid long-term potential. While short-term volatility is unavoidable, the broader structure supports continued growth.

Market View: Bullish