As blockchain technology moves closer to mainstream financial adoption, one challenge stands above all others: real-world assets require trust, privacy, and legal clarity. Assets such as equities, bonds, funds, and real estate operate under strict regulatory frameworks. They cannot function on systems where every transaction, balance, and relationship is publicly visible. Dusk Network was built specifically to solve this problem by providing blockchain infrastructure designed for regulated finance, not speculative experimentation.

Most public blockchains prioritize radical transparency. While this works for open cryptocurrencies, it fails for institutional finance. Financial markets rely on confidentiality. Ownership structures, transaction sizes, counterparty identities, and contractual terms cannot be exposed to the public. Dusk takes a different approach by making privacy a native feature of the blockchain rather than an optional add-on.

At its core, Dusk Network is a privacy-focused Layer 1 designed for compliant financial assets. It enables confidential ownership, private transactions, and verifiable execution while still allowing oversight when required. This balance between privacy and auditability is essential for institutions that must meet regulatory obligations without compromising sensitive information.

A defining feature of Dusk is confidential ownership with selective disclosure. Asset holders can prove ownership, compliance status, or transaction validity without revealing private details to the public. When legally required, regulators or auditors can be granted access to specific information. Everyone else remains excluded. This mirrors traditional financial disclosure models, but with cryptographic enforcement instead of trust in intermediaries.

Dusk achieves this through advanced cryptography, including zero-knowledge proofs. These technologies allow the network to verify transactions and smart contract logic without exposing the underlying data. Privacy does not weaken security on Dusk. Instead, it strengthens adoption by making blockchain usable for institutions that cannot operate on fully transparent systems.

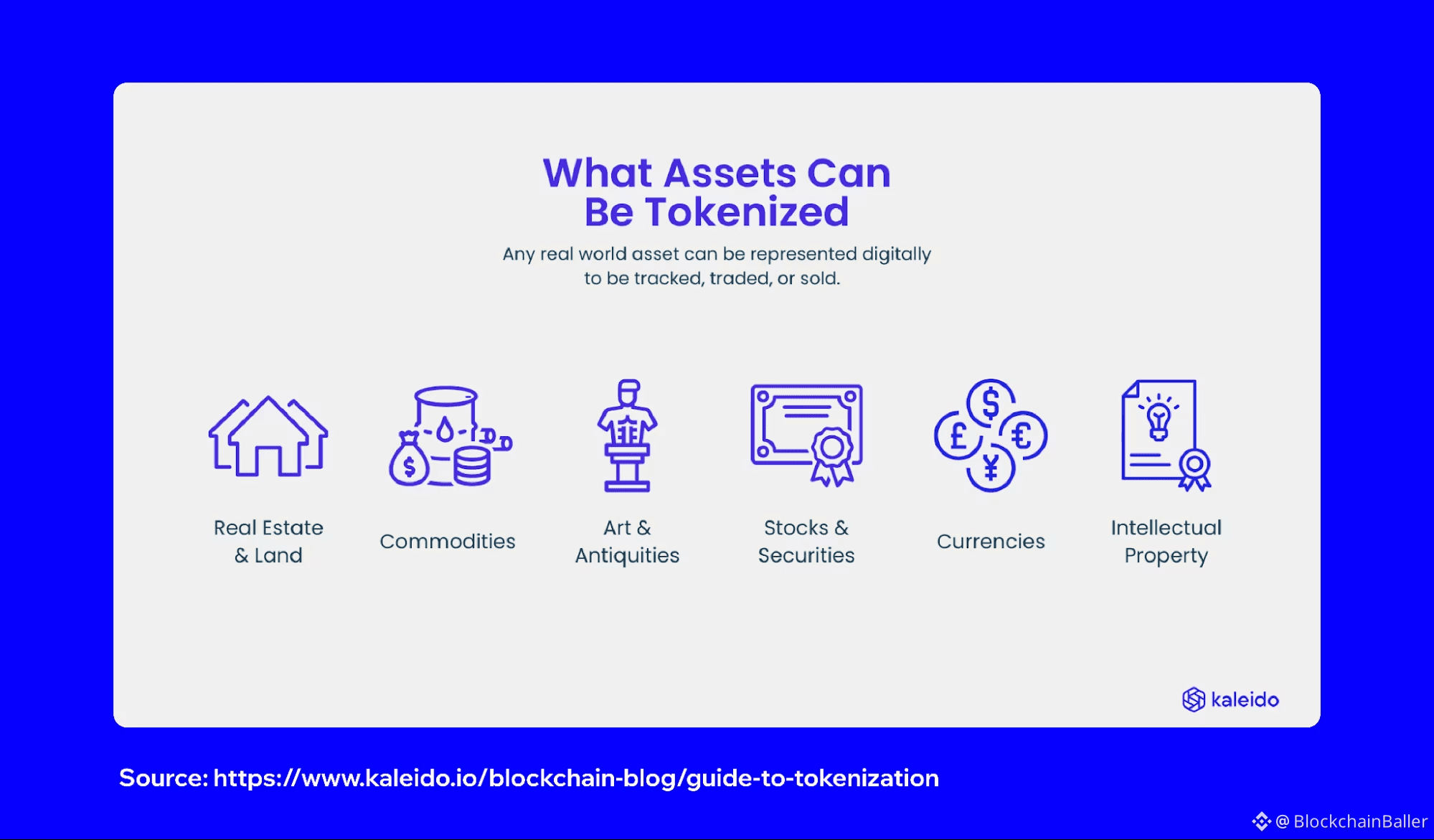

The network is purpose-built for tokenized real-world assets. Dusk supports the issuance, transfer, and lifecycle management of security tokens, equity representations, debt instruments, and other regulated financial products. These tokens can represent real legal claims while benefiting from on-chain automation, faster settlement, and reduced operational friction.

Regulatory alignment is embedded directly into the Dusk architecture. Compliance rules such as KYC, AML, jurisdictional restrictions, and transfer permissions can be enforced at the protocol and smart contract level. This ensures assets only move when all legal conditions are met, significantly reducing risk for issuers, investors, and intermediaries.

Another critical capability of Dusk is private smart contracts. On most blockchains, smart contracts execute publicly, exposing all inputs and outputs. This is unsuitable for financial agreements that contain confidential terms. Dusk allows smart contracts to operate on encrypted data, enforcing logic while keeping sensitive details hidden. This makes it possible to build complex financial products on-chain without exposing proprietary or client information.

For institutions, this changes the blockchain adoption equation. Banks, asset managers, and financial service providers can use decentralized technology without revealing strategies, internal processes, or customer data. Dusk behaves like professional financial infrastructure rather than a public experiment.

The DUSK token plays a functional role within the ecosystem. It is used for network security through staking, payment of transaction and execution fees, and participation in decentralized governance. Validators stake DUSK to secure the network, while token holders help guide protocol upgrades and long-term development. The token is designed to support utility, security, and alignment rather than short-term speculation.

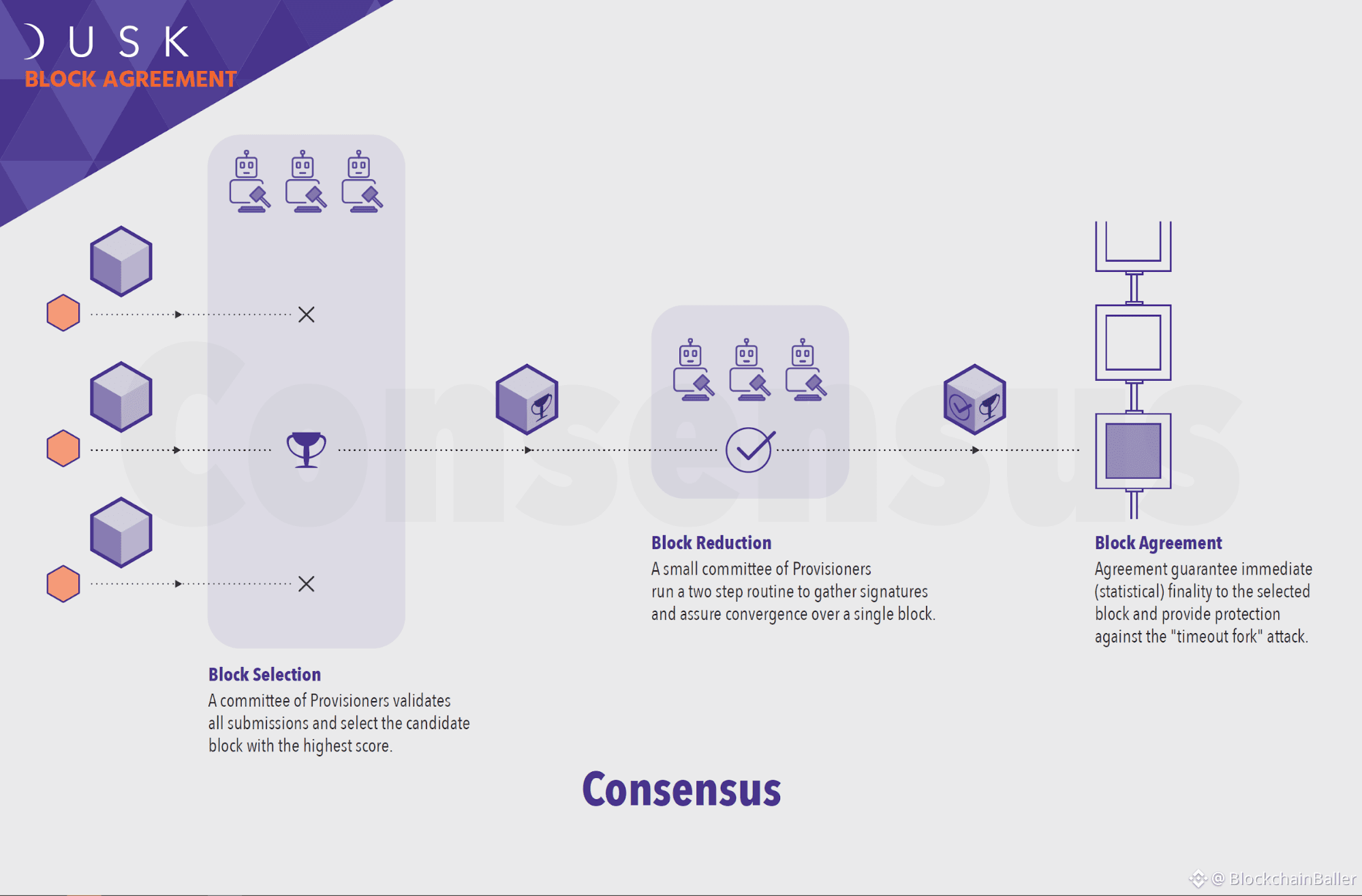

Dusk’s network design prioritizes finality and resilience. Financial markets require certainty. Once ownership changes, it must be irreversible and legally reliable. Dusk is engineered to provide strong settlement guarantees, making it suitable for high-value and regulated assets where trust is non-negotiable.

While finance is its primary focus, Dusk’s infrastructure can extend to other sectors that require private ownership and controlled disclosure. These include private markets, real estate registries, intellectual property systems, and identity frameworks. Still, Dusk remains disciplined in its mission: enabling compliant, privacy-preserving finance on blockchain.

What truly sets Dusk apart is its realism. It does not expect regulators or institutions to change how they operate to fit blockchain technology. Instead, it adapts blockchain to the realities of law, regulation, and institutional responsibility. This pragmatic approach is what allows Dusk to move beyond pilots and into real production use.

As tokenized real-world assets transition from theory to execution, infrastructure quality will matter more than narratives. Systems that ignore privacy or compliance will struggle to attract serious capital. Dusk positions itself as the blockchain layer where traditional finance and decentralized technology can meet without compromise.

In essence, Dusk Network is not trying to bypass financial rules. It is embedding them directly into blockchain infrastructure. By combining confidentiality, selective disclosure, private smart contracts, and regulatory-aware design, Dusk provides the missing foundation for real-world assets to operate on-chain in a secure, trusted, and legally sound way.