📉 Recent Price & Market Context

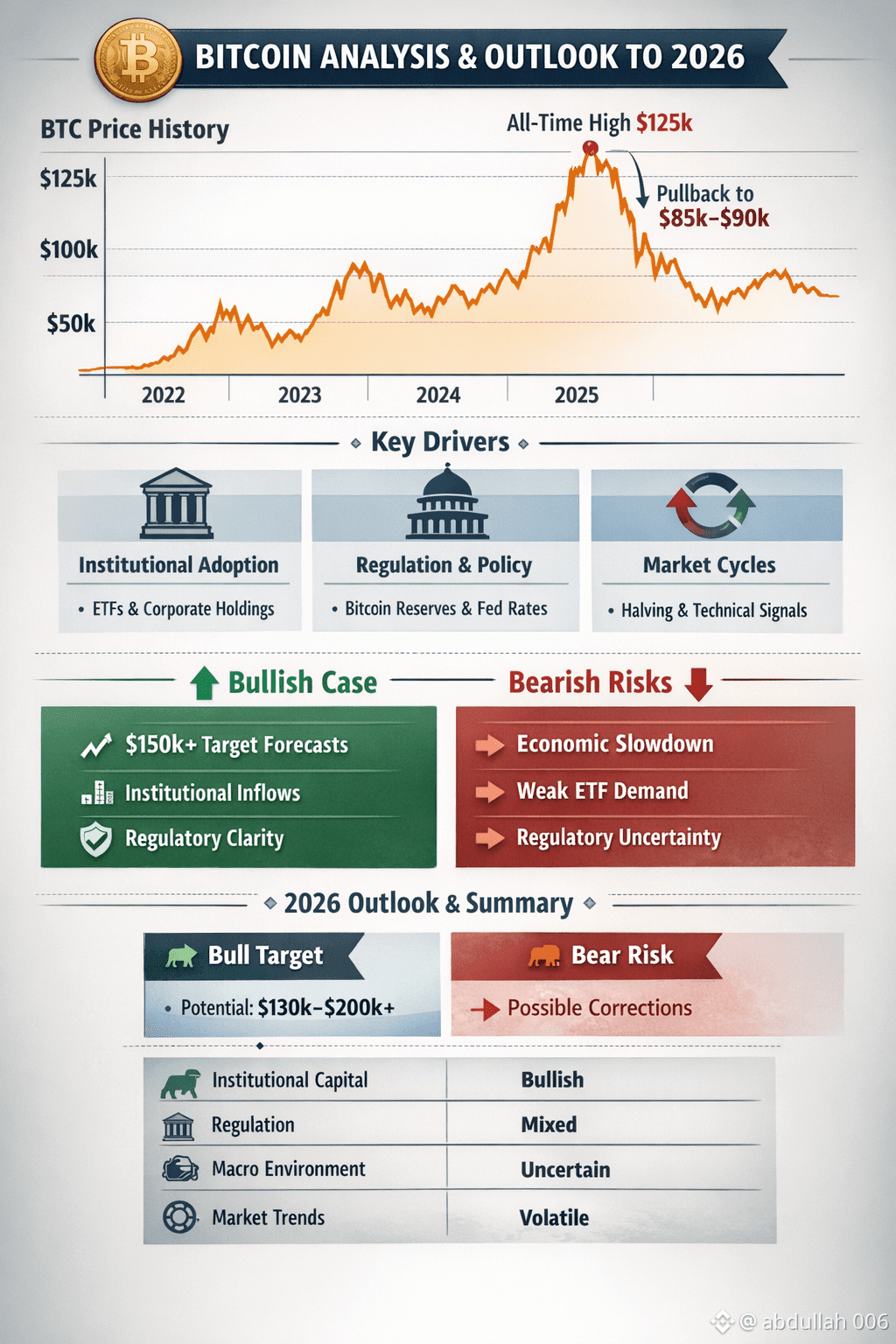

Bitcoin rallied to all-time highs above ~$125,000 in 2025 driven by strong institutional demand, ETF flows, and macro liquidity optimism. �

Reuters +1

However, later in 2025 it pulled back sharply, ending the year down more than 6% — a rare annual loss since 2022 — with prices around the $85k–$90k area. �

Reuters

Market moves were sensitive to macro trends, including policy shifts and tariff-induced liquidations. �

Reuters

Investors have seen high volatility: $BTC

rose to fresh highs but gave back a large portion of gains by year-end — reflecting its continued status as a risk asset linked to broader financial markets.

🧠 Key Drivers of BTC’s Price Action

📊 Institutional Adoption & Supply Dynamics

Analysts and reports forecast potential institutional demand growth into 2026 through Bitcoin ETPs and corporate holdings. �

tmgm.com +1

Some forecasts project BTC targeting $150,000 or higher by end-2026, though with wide bands depending on market participation and macro conditions. �

Cointelegraph

Institutional flows (including sovereign wealth and corporate treasuries) could tighten circulating supply if holdings grow. �

MEXC Blog

🧾 Regulatory Clarity & Macro Policy

The U.S. Strategic Bitcoin Reserve initiative (government holding BTC as a reserve asset) reflects shifting legitimacy and possible demand from institutional layers. �

Wikipedia

Pro-crypto regulatory momentum and potential legislative clarity could reduce friction for institutional capital. �

AInvest

Federal Reserve interest rate expectations (e.g., potential cuts) could bolster risk assets like Bitcoin. �

Business Insider

🌀 Market Cycle Dynamics

Traditional “four-year halving cycles” are being debated among traders — some see the classic pattern breaking, others see room for renewed expansion if BTC finds structural support. �

Reddit +1

Technical factors show mixed signals: bearish near-term trends per some traders, but other indicators (like golden crosses) suggest rebound potential. �

Reddit +1

📊 Bullish Case

📈 Reasons BTC could climb in 2026

Institutional adoption scaling via ETPs and corporate treasuries. �

tmgm.com

Regulatory frameworks that integrate Bitcoin into traditional finance and retirement systems. �

AInvest

Potential interest rate cuts that favor risk assets. �

Business Insider

Forecasts from major research firms expecting ~ $150k targets and structural demand. �

Cointelegraph

📉 Bearish Risks

⚠️ Macroeconomic & Market Risks

BTC’s price may remain correlated with broader risk sentiment and equities. �

Reuters

Drawdowns or technical bear markets can persist — some models suggest potential lows far below current levels if sell pressure increases. �

Cointelegraph

⚠️ Liquidity & Flow Constraints

Slowed ETF inflows and reduced corporate buying could weaken demand compared to prior cycles. �

The Economic Times

Short-term sentiment can remain bearish if macro headwinds or tighter monetary conditions persist.

⚠️ Regulatory Uncertainty

While some moves are supportive, evolving global regulation still poses risks to institutional confidence and access (e.g., taxation, custody rules).

🔮 Outlook — What to Watch in 2026

Bull Case Targets

Many institutional forecasts point to BTC in the $130k–$200k+ range by late 2026, driven by structural and regulatory adoption. �

Cointelegraph

Bear/Macro Risks

BTC could revisit consolidation zones or deeper corrections before broader uptrends resume. �

Cointelegraph

Key Catalysts

Passage of clearer crypto market rules in key markets.

ETF and institutional capital flows accelerating.

Fed monetary policy direction.

Technical breakouts above major resistance levels.