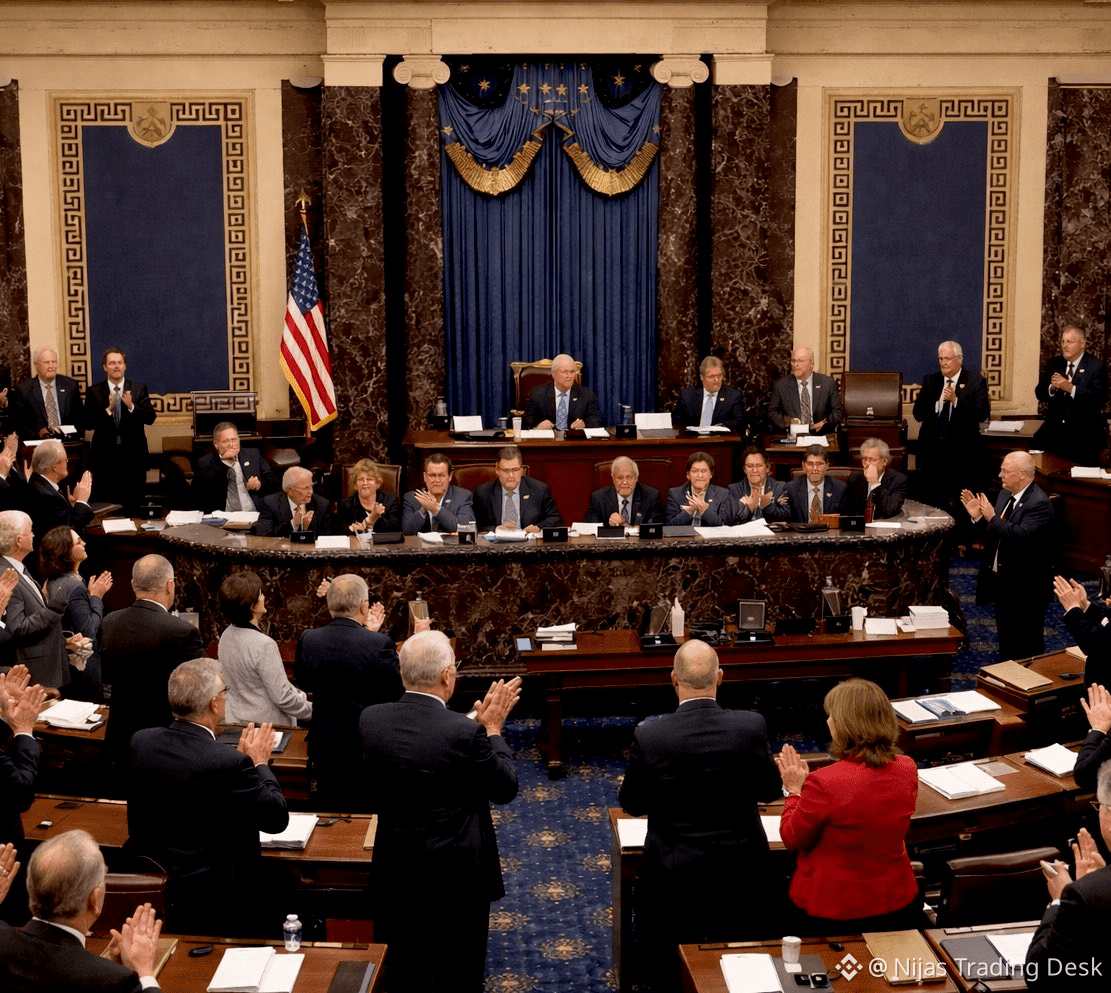

The U.S. Senate is gearing up to vote on the highly anticipated crypto market structure bill in just three days, a decision that could reshape the landscape of digital assets in the country. This bill aims to bring clarity to the regulatory framework for cryptocurrency exchanges, trading platforms, and market participants, addressing issues such as investor protection, market transparency, and oversight of digital asset products.

Analysts believe that the vote could have a major impact on market sentiment. A favorable outcome may increase institutional participation, strengthen confidence in U.S.-based exchanges, and potentially attract billions of dollars in capital into the crypto ecosystem. Conversely, strict or restrictive measures could trigger short-term volatility, reduce liquidity, and slow down the adoption of innovative crypto products.

📊 Key implications for the market:

Institutional inflows: Clear rules could encourage hedge funds, banks, and corporate treasuries to enter the market with confidence.

Exchange operations: U.S. exchanges may gain a competitive advantage if regulations standardize compliance and trading practices.

Price action: Major cryptocurrencies like Bitcoin and Ethereum could see significant moves as traders react to both anticipation and the final outcome.

Investor protection: Improved transparency and oversight may reduce fraud, manipulation, and other market risks, benefiting retail traders.

With only three days remaining, the crypto community is closely monitoring news updates, Senate discussions, and market reactions. Traders and investors should stay vigilant, track price movements, and manage risk, as this vote could mark a turning point for U.S. crypto regulation.