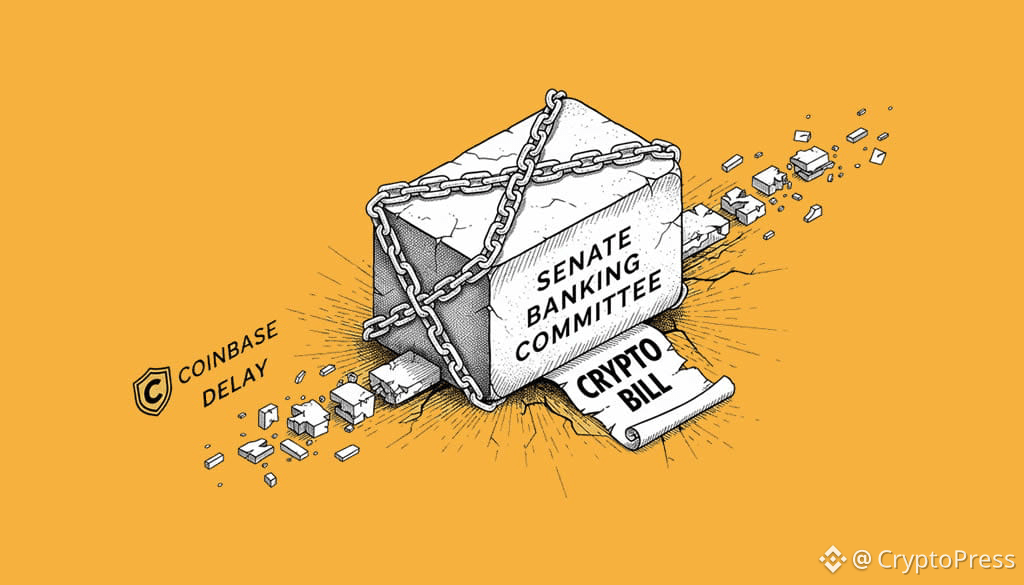

The U.S. Senate Banking Committee postponed a markup on landmark crypto legislation after Coinbase withdrew support.

CEO Brian Armstrong cited provisions that could harm consumers, stifle competition, and erode CFTC authority.

Stakeholders anticipate a revised draft in coming weeks to address industry concerns.

The U.S. Senate Banking Committee has postponed a scheduled markup of a major cryptocurrency regulation bill following strong opposition from Coinbase, the leading U.S. crypto exchange.

Coinbase’s stance highlights potential risks to innovation and consumer rights. In a detailed post on X, CEO Brian Armstrong outlined key issues with the draft, including a de facto ban on tokenized equities, DeFi restrictions that could undermine privacy, diminished authority for the Commodity Futures Trading Commission (CFTC), and measures that would eliminate rewards on stablecoins.

After reviewing the Senate Banking draft text over the last 48hrs, Coinbase unfortunately can’t support the bill as written.There are too many issues, including:– A defacto ban on tokenized equities– DeFi prohibitions, giving the government unlimited access to your financial…

— Brian Armstrong (@brian_armstrong) January 14, 2026

“After reviewing the Senate Banking draft text over the last 48hrs, Coinbase unfortunately can’t support the bill as written,” Armstrong stated. He emphasized that the legislation “would be materially worse than the current status quo,” adding, “We’d rather have no bill than a bad bill.”

The bill sought to establish a clear regulatory framework for digital assets. It aimed to classify crypto tokens as securities or commodities, addressing long-standing industry calls for clarity. However, according to Armstrong in an interview with CNBC, certain provisions could prove “catastrophic” for consumers and competition, prompting the company’s last-minute opposition.

The committee canceled the markup on January 15, 2026, hours after Armstrong’s public statement, as reported by Reuters. Sources indicate negotiations continue, with a revised version potentially emerging soon.

Industry and political reactions underscore the bill’s challenges. Armstrong accused banking lobbyists of pushing restrictions on stablecoin rewards to eliminate competition, per Bloomberg. Meanwhile, The New York Times noted the opposition reflects broader tensions between crypto firms and traditional finance.

Broader implications for the crypto ecosystem. The delay comes amid ongoing efforts to integrate cryptocurrencies like Bitcoin and BNB into mainstream finance. Stablecoins, often used for trading and yield generation, could face significant changes if the bill advances without revisions.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

The post Senate Banking Committee Delays Crypto Bill Markup Following Coinbase Opposition appeared first on Cryptopress.