Most blockchains begin with a technical breakthrough and only later ask how people might actually use it. Payments usually come last. First there is a native token, then smart contracts, then decentralized apps, and eventually stablecoins arrive as just another asset in the mix. By that point, the rules of the system are already set. Fees exist. Gas tokens are mandatory. Users have to understand things they never asked for. Plasma starts from a different place. It begins with a simple observation. For a large number of people, the main reason to touch crypto at all is to move dollars. Not to speculate. Not to govern protocols. Just to send, receive, and hold value that behaves like money. Plasma treats that behavior not as an edge case, but as the core design constraint. Instead of asking how stablecoins can fit into a blockchain, it asks what a blockchain should look like if stablecoins are the reason it exists.

This starting point quietly changes everything. On Plasma, stablecoins are not a late addition or a secondary feature. They shape the user experience, the economic model, and even the mental model of how the chain is meant to be used. The goal is not to teach users how blockchains work. The goal is to remove the need for them to care. When someone sends USDT on Plasma, they are not expected to hold a separate gas token or understand fee markets. They are simply moving dollars from one place to another. That may sound like a small shift, but it cuts directly against one of the biggest sources of friction in crypto today. For years, users have been asked to juggle multiple assets just to complete a basic action. Plasma’s bet is that adoption does not come from better explanations, but from removing the problem entirely.

At the same time, Plasma avoids another common trap. It does not force developers to start over. The chain is fully EVM-compatible, which means developers can use the same tools, wallets, and smart contracts they already know from Ethereum. This matters more than it might seem. New virtual machines and custom languages often promise better performance, but they also create isolation. Teams have to retrain. Auditors have to learn new patterns. Users have to install unfamiliar wallets. Plasma chooses familiarity on purpose. It keeps the environment developers trust, while changing what the chain optimizes for. That combination is rare. On one side, you get a payment-focused design that feels closer to fintech than crypto. On the other, you get an execution layer that feels immediately usable to anyone who has built on Ethereum before.

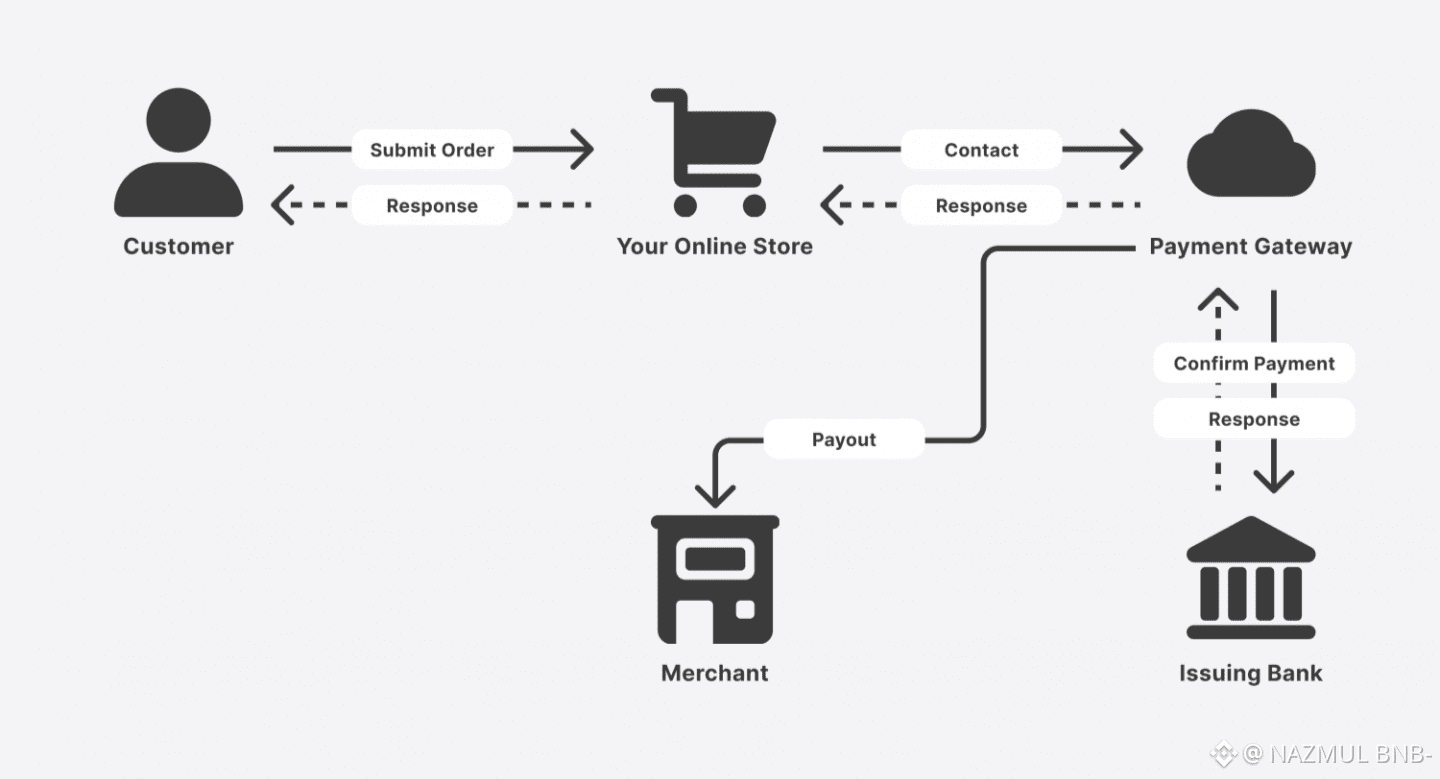

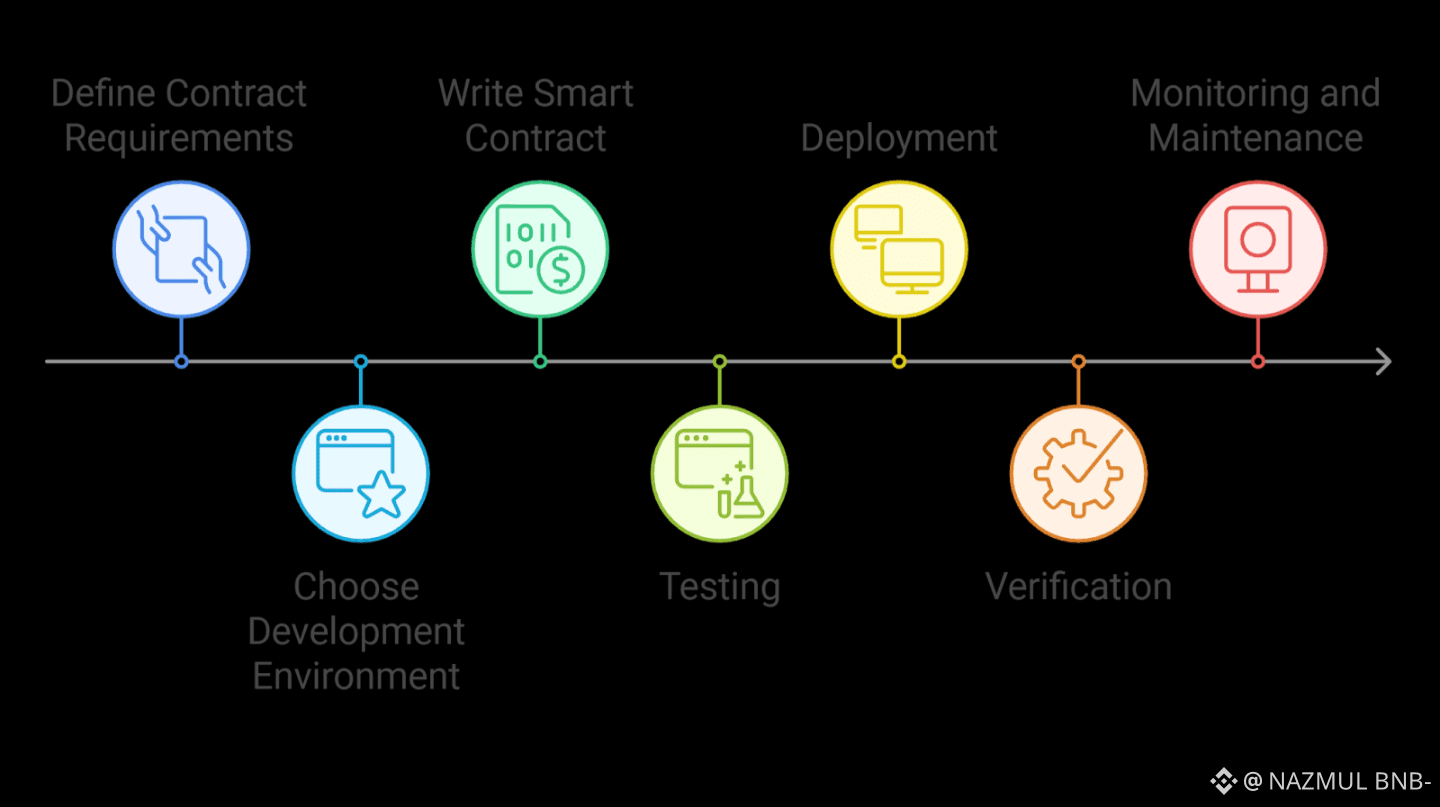

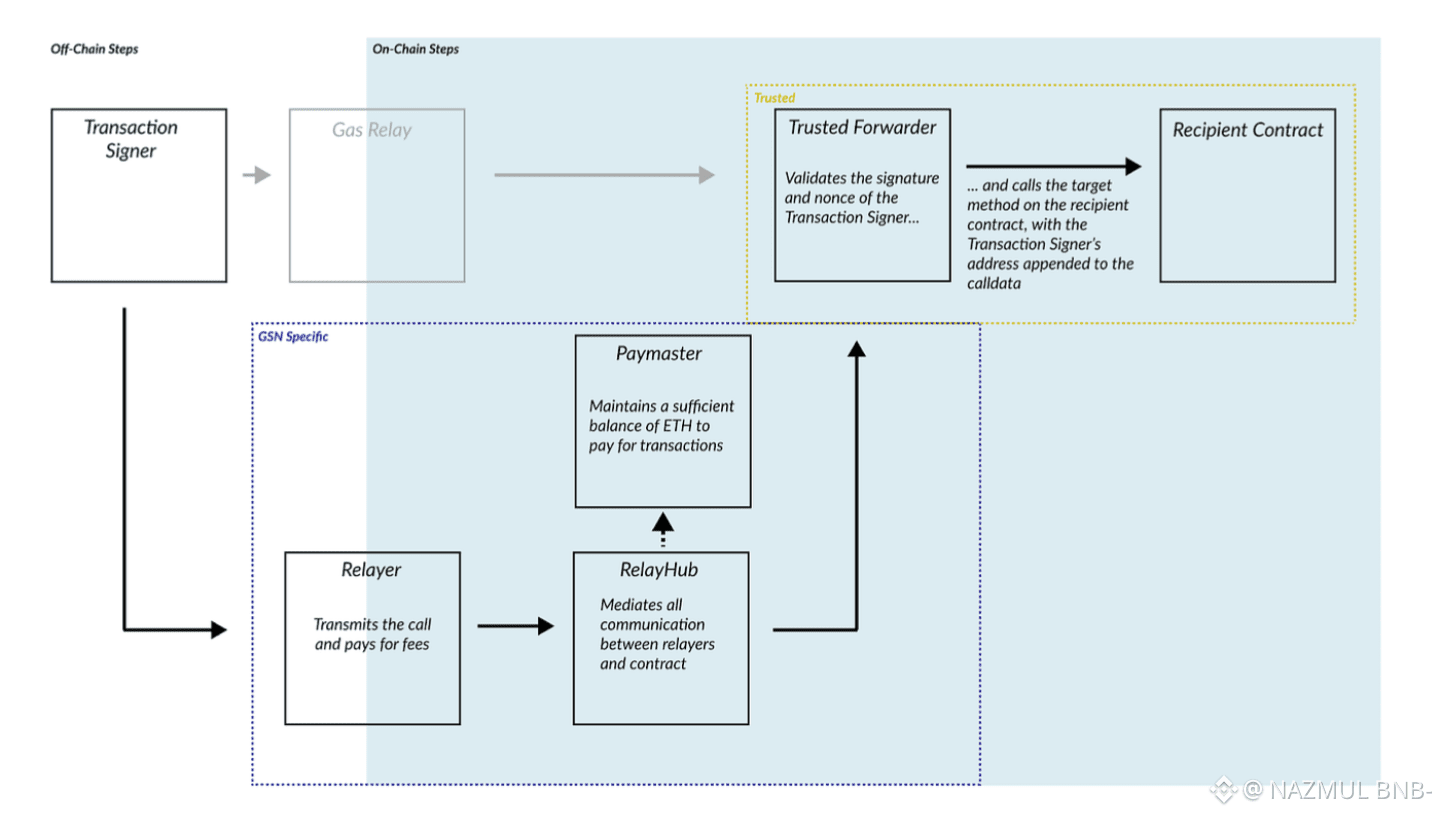

The most talked-about feature of Plasma is zero-fee USDT transfers, and it is easy to misunderstand what that actually means. Blockchains are never free. Someone always pays. Plasma does not try to hide this reality. Instead, it shifts where the cost is handled. The network uses a paymaster or relayer system that can cover gas fees for specific actions, like standard USDT transfers. From the user’s perspective, the fee disappears. There is no prompt. No calculation. No need to hold anything other than the stablecoin itself. Behind the scenes, the system is carefully constrained. The fee sponsorship applies to narrow use cases and operates with clear limits. This is not a blank check for unlimited activity. It is a targeted decision to remove friction from the most common action on the chain.

This design choice is less about generosity and more about realism. In traditional payment systems, users do not think about network fees. They do not calculate routing costs or settlement complexity. Those costs exist, but they are absorbed by institutions, merchants, or platforms that have a reason to pay them. Plasma brings that same logic on-chain. Applications built on top of it can decide when it makes sense to sponsor fees, and when it does not. The result is a user experience that feels closer to sending money through a banking app than interacting with a blockchain. That familiarity is not accidental. It is the point.

Underneath this user-facing simplicity sits a performance-focused infrastructure. Plasma is designed to handle high transaction throughput with low latency, which is a practical requirement for any chain that wants to support real payment flows. Payments are not occasional events. They are repetitive, frequent, and time-sensitive. A system that pauses, spikes in cost, or behaves unpredictably under load cannot fill that role. Plasma’s consensus and execution design aim to prioritize consistency over experimentation. This is not about chasing maximum theoretical performance. It is about delivering something stable enough to be relied on. In payments, reliability often matters more than novelty.

There is also a broader strategic layer to Plasma’s approach. By centering stablecoins, the chain naturally aligns with remittances, merchant payments, payroll, and cross-border transfers. These are not abstract use cases. They already exist today, mostly handled by slow or expensive systems. Crypto has long claimed it could do better, but the user experience rarely matched the promise. Plasma does not claim to fix everything. Instead, it narrows its focus. It chooses one job and tries to do it well. That restraint is notable in an industry that often tries to be everything at once.

Of course, this approach comes with trade-offs. Someone has to fund the fee sponsorship. Guardrails have to be enforced to prevent abuse. Compliance expectations cannot be ignored when the core asset is dollar-linked. Plasma’s design acknowledges these realities rather than pretending they do not exist. It does not market zero fees as magic. It frames them as a deliberate economic choice. Whether that choice scales sustainably will depend on partnerships, usage patterns, and how value flows through the ecosystem over time. These are open questions, and pretending otherwise would be dishonest.

What Plasma ultimately represents is a shift in priorities. It treats stablecoins not as a feature, but as infrastructure. It treats developers not as early adopters to be retrained, but as professionals whose time matters. And it treats users not as hobbyists, but as people who just want to move money without friction. That does not guarantee success. But it does signal maturity. In a space often driven by novelty, Plasma’s most interesting quality may be its willingness to optimize for the ordinary. If crypto is ever going to blend into everyday financial life, it will likely look less like speculation and more like this.