Standard Chartered analyst Geoffrey Kendrick says XRP could reach $12.50 by 2028. That implies about 500 percent upside from its current price near $2.

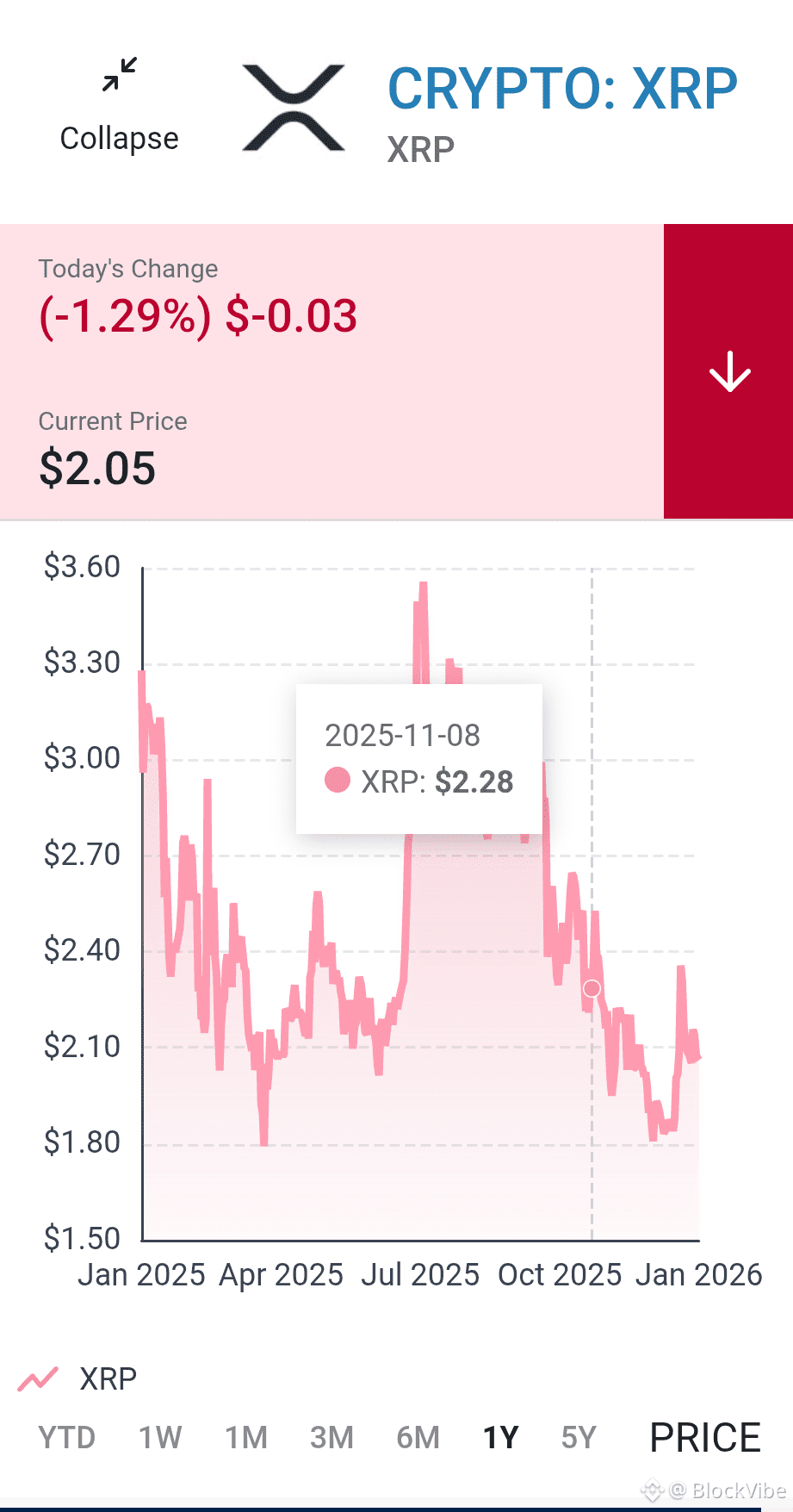

The crypto market has been volatile. Total market value fell around 9 percent over the past year due to economic uncertainty and deleveraging. XRP underperformed. Its price dropped about 22 percent year over year.

Kendrick believes XRP will rebound for two reasons. First is payments. XRP runs on the XRP Ledger, a blockchain built for fast and low cost cross border and cross currency transfers. Ripple uses this network to serve banks, payment firms, and crypto businesses. Compared to SWIFT, which can take three to five days and high fees, XRP settles almost instantly with minimal cost. Ripple claims SWIFT handles over $150 trillion annually and says XRP could process 14 percent of that volume. Critics say this is unrealistic because XRP is volatile and stablecoins are better for payments. Ripple launched its stablecoin RLUSD in December 2024, but adoption has been limited and XRP transaction volume declined over the last year.

Second is ETFs. In late 2025, the SEC approved spot XRP ETFs. Six funds now trade in the US, giving exposure through brokerage accounts with lower fees than crypto exchanges. The Franklin XRP ETF charges 0.19 percent. Kendrick estimates ETF inflows of $4 to $8 billion in the first year. Institutions control about $147 trillion in assets, so even small allocations could move price.

The counter view is cautious. Institutions still prefer Bitcoin. Spot XRP ETFs attracted about $1.4 billion in two months, slower than Bitcoin ETFs. XRP’s future upside depends mainly on sustained ETF demand.