When I first started paying attention to blockchain metrics, I was obsessed with speed. Blocks per second. Transactions per second. Faster felt better. It took a while to realize that speed is only impressive when the outcome actually settles. Without settlement, throughput is just motion.

That distinction is becoming harder to ignore as crypto keeps trying to talk to real finance. Speculation tolerates reversibility. Settlement does not. Once you see that difference clearly, you start to understand why some projects quietly stop chasing raw throughput and start designing for finality instead. That is where Dusk Network fits into the conversation.

On the surface, Dusk looks like another Layer 1. It has blocks, validators, smart contracts. Nothing shocking there. Underneath, though, its priorities feel different. The system is tuned less around how fast transactions move and more around when they are considered done. That may sound subtle, but in finance it changes everything.

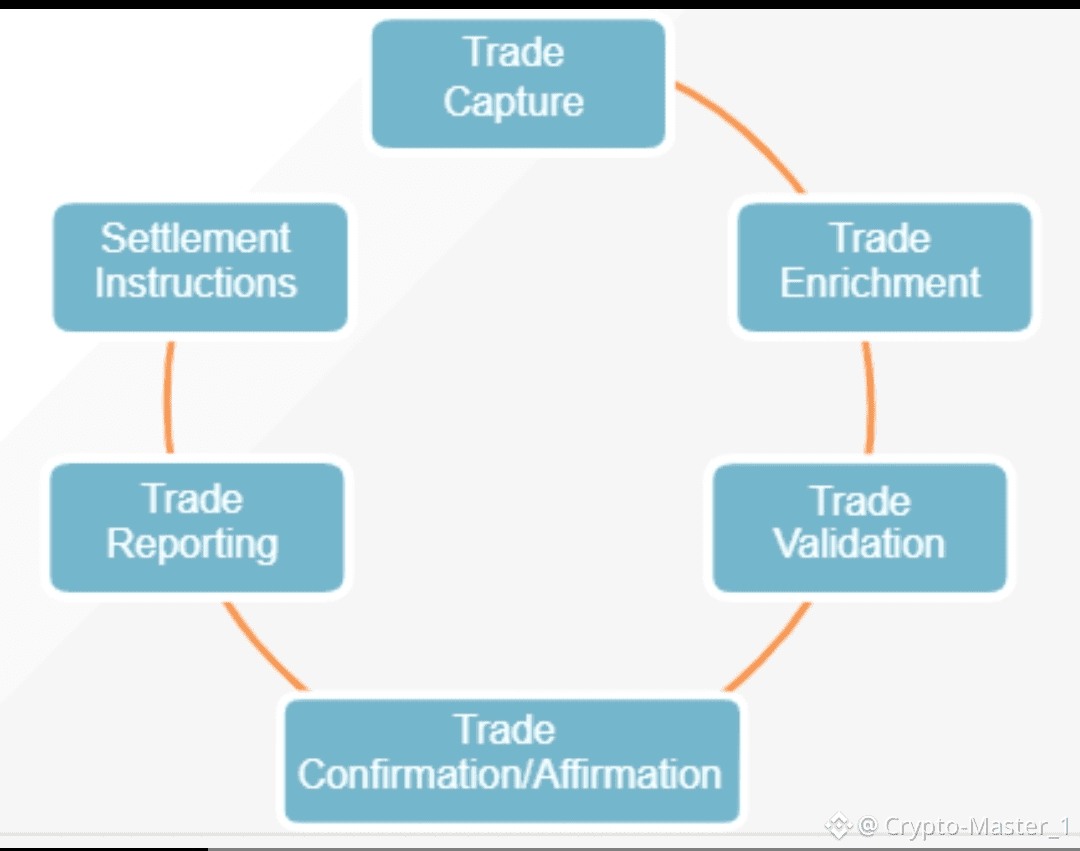

Finality is not just a technical word. In traditional markets, it is the moment after which a transaction cannot be unwound without legal process. Equity settlement often happens on T plus 2. That delay exists because institutions need certainty, reconciliation, and compliance checks. Crypto compressed that timeline dramatically, but it often skipped the legal and procedural weight that makes settlement meaningful.

Understanding that helps explain why throughput-heavy chains struggle to attract regulated activity. If a chain can process 50,000 transactions per second but cannot tell a regulator when a trade is final, the speed becomes irrelevant. Institutions care about when obligations crystallize, not how fast messages propagate.

What struck me when looking at Dusk is how intentionally it treats finality as a product feature rather than a side effect. Its consensus and execution model are designed so that once a transaction is finalized, it carries legal and operational weight. That weight is earned through verifiability and privacy working together, not competing.

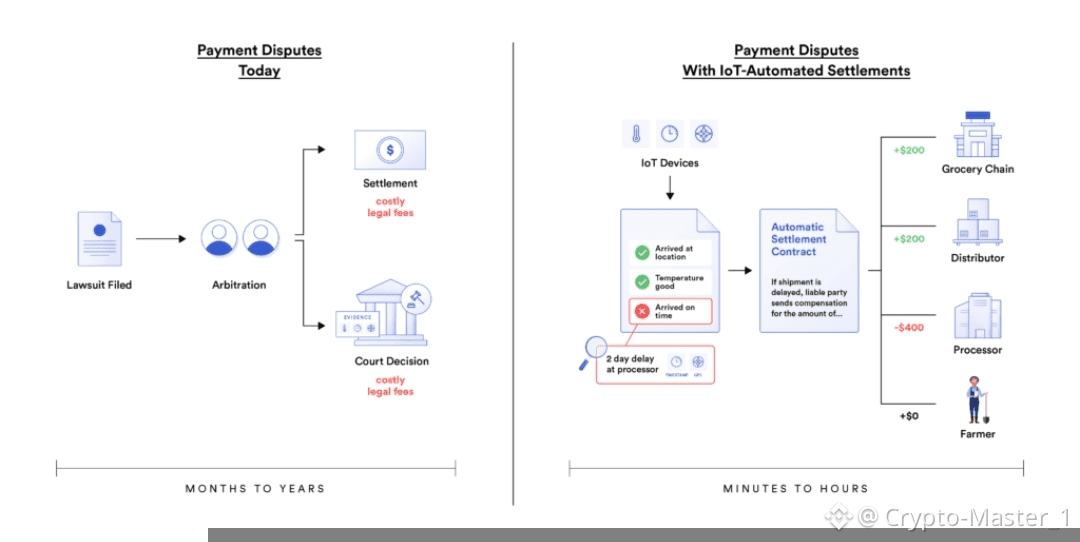

Here is where the architecture matters. On the surface, a Dusk transaction confirms like any other. Underneath, zero-knowledge proofs are doing quiet work. Instead of revealing every trade detail to the network, the system proves that rules were followed. Identity constraints met. Transfer limits respected. Asset eligibility verified. The network agrees on correctness without broadcasting sensitive data.

Translate that into plain terms and it starts to look like settlement infrastructure rather than trading infrastructure. The proof is the receipt. That receipt can be audited later by authorized parties, which is how compliance enters the picture without forcing public disclosure. This is not about hiding activity. It is about defining who gets to see what and when.

The numbers around this design choice are modest but revealing. Over the past two years, tokenized securities pilots have expanded to dozens of jurisdictions, with several reports placing on-chain real-world asset value between $8 and $10 billion depending on scope. That figure is tiny compared to global markets, but the trend matters. Most of that value sits in private or semi-private deployments, not public DeFi pools.

That momentum creates another effect. As more institutions test on-chain settlement, they start asking different questions. Not how fast can we trade, but how quickly can we reconcile. Not how cheap is gas, but how predictable is finality. Dusk’s focus lines up with those questions in a way throughput races do not.

There is also a timing element. Right now, in early 2026, regulators are shifting from experimental guidance to supervisory frameworks. That changes risk calculations. A chain that can demonstrate enforceable settlement rules becomes easier to justify internally. One that cannot becomes harder to defend, regardless of performance metrics.

Of course, this approach is not without tradeoffs. Designing for finality can reduce composability. Private transactions do not plug into every open liquidity pool. Selective disclosure introduces governance complexity. Who can audit. Under what conditions. Using which standards. These are real risks, and early signs suggest they slow ecosystem growth compared to permissionless environments.

But that slowdown might be the point. Financial settlement has never been about growth at all costs. It has been about minimizing dispute. When a bond settles, nobody wants optionality. They want certainty.

What makes Dusk interesting is that it does not frame this as a rejection of DeFi, but as a different lane. Speculative trading can live on chains optimized for speed and openness. Regulated settlement needs a different texture. One that is quieter. More deliberate. Less forgiving of ambiguity.

Meanwhile, market behavior reinforces this split. Public DeFi volumes have oscillated with sentiment, while institutional pilots continue regardless of price cycles. Even during downturns, settlement experiments persist because they are infrastructure projects, not trades. That persistence hints at where long-term value is accumulating.

If this holds, we may look back and see that the throughput era was a necessary phase, but not the destination. It taught us how to move value cheaply and quickly. The next phase is teaching us how to stop it, conclusively, in a way courts, regulators, and balance sheets recognize.

The risk, of course, is overfitting to current regulation. Rules change. Standards evolve. A chain built too tightly around today’s compliance logic could struggle tomorrow. Dusk’s bet seems to be that selective disclosure and proof-based verification are flexible enough to adapt. That remains to be seen.

Still, there is something quietly persuasive about designing for the end of a transaction rather than the beginning. Throughput gets attention. Settlement earns trust. And in finance, trust is what turns activity into infrastructure.