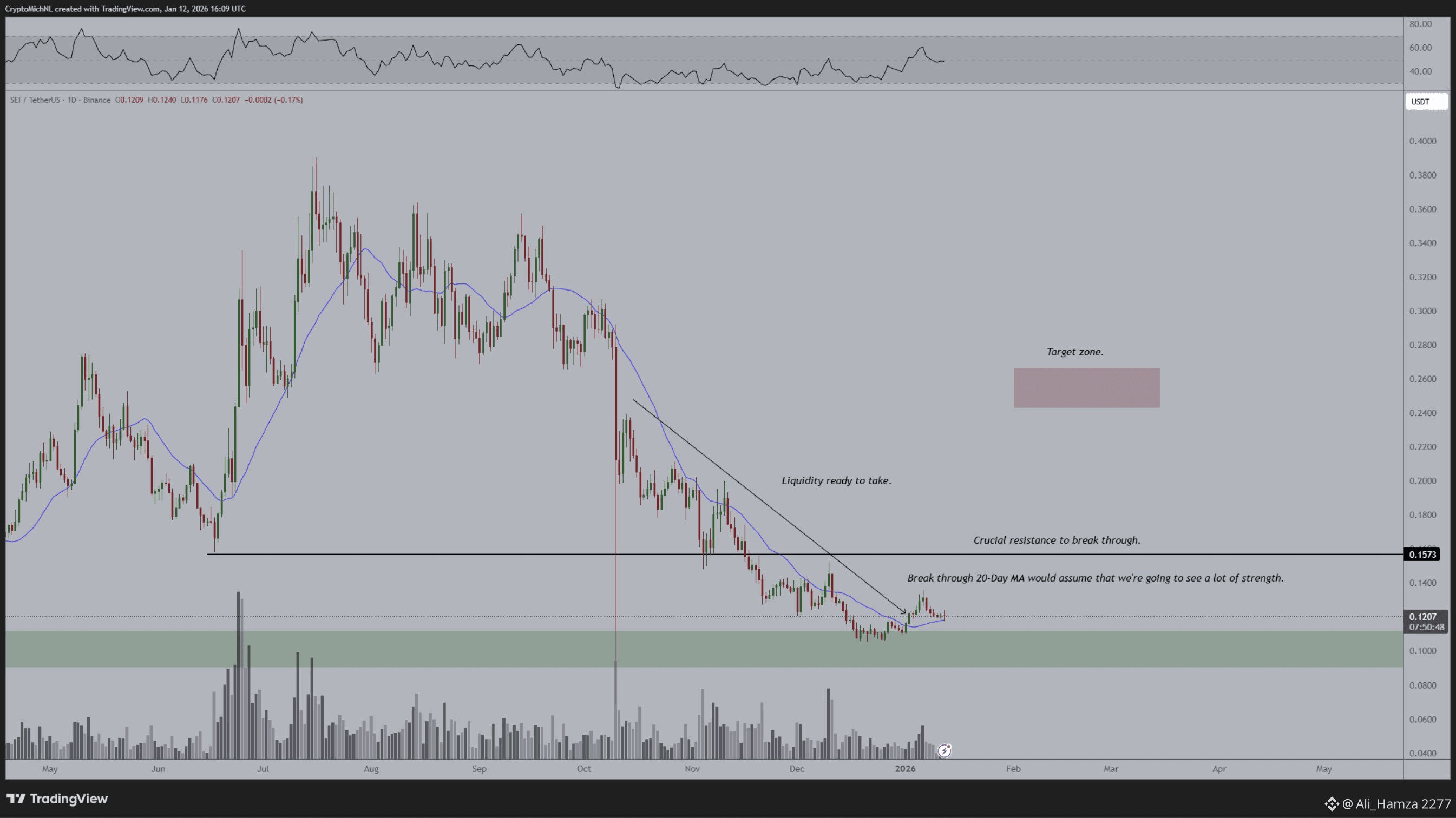

SEI Reclaims 21-Day MA — Continuation Setup in Play

$SEI continues to show relative strength, moving in sync with the broader altcoin market recovery. Price action has shifted decisively bullish after reclaiming a key moving average, suggesting buyers are regaining control and positioning for the next upside expansion.

📊 Technical Analysis Breakdown

🔹 21-Day Moving Average Breakout

$SEI has successfully broken above the 21-Day MA, a level often used to gauge short-term trend direction. This reclaim signals a potential trend shift from corrective to impulsive.

🔹 Healthy Support Retest

Price is currently retesting the 21-Day MA as support, and holding firmly — a textbook continuation behavior seen before strong follow-through moves.

🔹 Bullish Market Structure

Higher lows remain intact, and selling pressure continues to weaken, reinforcing a bullish bias as long as the moving average holds.

📍 Key Levels to Watch

Immediate Support

21-Day MA (dynamic support)

Resistance / Trigger Level

0.1571 — Break & close above this level can unlock liquidity

Upside Targets

0.1680 – 0.1750 — First reaction zone

0.1850+ — Extension area (momentum dependent)

📈 Liquidity & Momentum Outlook

Liquidity remains stacked above recent highs. A clean breakout above 0.1571, supported by volume expansion, could trigger a rapid price acceleration as stops and breakout orders get filled.

🧠 Trading & Holding Strategy

Bias: Bullish while price holds above the 21-Day MA

Entry: Break & hold above 0.1571 (4H / Daily close preferred)

Targets: Scale profits into resistance zones

Invalidation: Daily close below the 21-Day MA

💡 Risk Tip: Move stop loss to breakeven after first upside reaction to protect capital.

🔥 Final Take

As long as $SEI remains above its 21-Day MA, the structure favors continuation. A confirmed breakout above 0.1571 could mark the start of the next impulsive leg higher.

📌 Follow the trend. Respect the levels. Manage the risk.