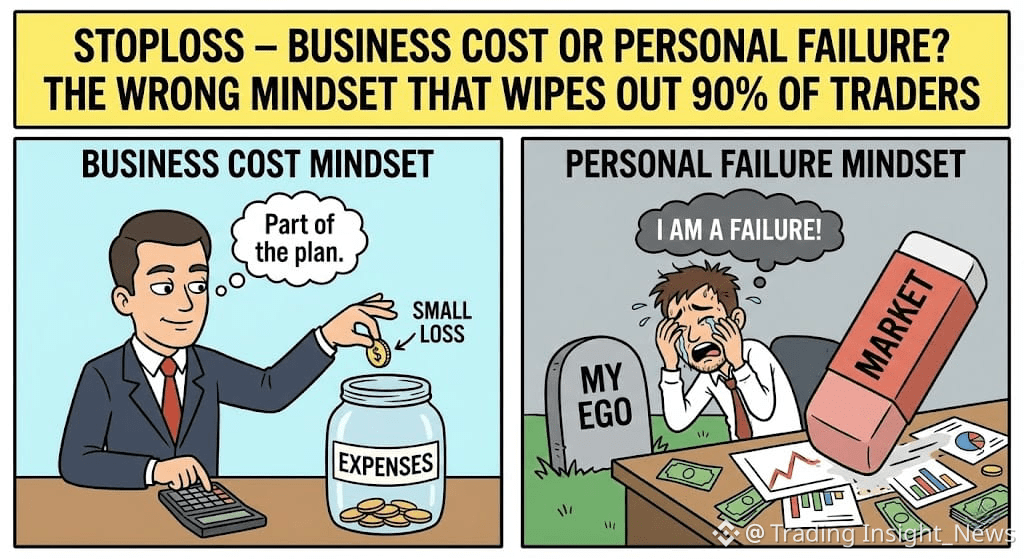

Many beginners view hitting a Stoploss as a personal failure or proof that they are bad at trading. Because of this ego, they often widen their Stoploss or, worse, remove it entirely, hoping the price will turn around.

🔸 In traditional business, you pay for rent, electricity, and staff. These are Operating Costs. In Trading, a Stoploss is simply your Business Cost.

You pay the market to look for opportunities.

If the trade is wrong, you pay a small fee this is Stoploss.

If the trade is right, the revenue orTake Profit must cover the costs and generate a profit.

🔸 Imagine a poisonous snake bites your finger (A 5% loss).

The Disciplined Trader cuts off the finger immediately. It hurts, but they survive.

The Stubborn Trader regrets losing the finger, waits for an antidote (Holding the loss). The poison spreads to the arm 30% loss, then to the heart or Account blown.

👉 Hitting a Stoploss does not mean you are wrong; it just means the probability was not on your side this time. Accept it happily like paying your monthly electricity bill. As long as you have capital, you have opportunities.

Have you ever widened your Stoploss because you believed the price would bounce back, only to watch your account get cut in half?

News is for reference, not investment advice. Please read carefully before making a decision.